Table of Contents

Table of Contents

Time tracking for contractors is crucial in today’s gig economy landscape. While staffing your company entirely with independent contractors might sound tempting, it comes with challenges and obligations. The growing distributed economy is increasingly regulated to protect these workers. It’s important to understand the costs, benefits, and obligations of using contractors and freelance workers, particularly if you plan to use an independent contractor time tracking tool.

With no need to pay taxes, overhead, or benefits it’s no wonder companies prefer to cut costs and hire independent contractors. They now make up nearly half of workers at most technology firms, and in the United States these companies can save $100,000 a year per worker by using contractors in place of full-time employees. What’s not to love?

When is someone an employee and when are they a contractor?

While laws vary by country or state, generally speaking labor laws concerning minimum wage, overtime pay, withholding obligations, workers’ compensation and so forth all hinge on whether or not an individual is an employee or an independent contractor. These added responsibilities and costs make it tempting for companies to misclassify workers, and there is constant litigation on the issue.

It’s important to remember that the determiner as to whether a worker is an employee is not simply the label an employer uses. An individual does not become an independent contractor under the law just because their employer chooses to classify them as so. Generally, the pertinent laws will set out a multi-part test that determines a worker’s classification. Take a look at your region’s laws to ensure your contract jobs are compliant.

Can a company be an independent contractor?

You might also be wondering if a company itself can be designated as an independent contractor. In short, no, a company can’t be considered an independent contractor. Remember, an independent contractor is someone who offers their services to the general public, and that person gets to decide what work to do and when to do it.

If you think of a company as a legal entity that can be structured in various ways—nonprofits, corporations, LLCs, S corporations, sole proprietorships, and more—then the distinction should be clear. Only people can be classified as independent contractors.

Note that an independent contractor might make the decision to create a sole proprietorship, which is a one-person business that’s not registered as either a corporation or an LLC. Sole proprietors are responsible for paying both income taxes and business debts, and they can also be held personally liable for any business obligation.

Whether operating as an independent contractor or a sole proprietor, tracking time on tasks, projects, and clients is absolutely key to understanding where your time goes, pinpointing top clients, and following through with accurate invoicing and billing.

The challenges for companies of managing a workforce of contractors

If you are confident that your independent contractors are correctly classified in your organization, great. But there are a number of other ongoing challenges and risks to hiring freelance workers. Aside from liability issues and compliance with ever-changing regulations, day to day management requires patience, communication, and clarity. Without them you’ll end up with missed deadlines, unclear expectations, and frustration on both ends.

Some typical challenges of managing a workforce with contractors are lack of oversight, difficulty in coordination of tasks and timelines and inconsistent performance. However, from our perspective, the riskiest of the challenges is keeping project cost overruns under control. Unexpected delays or scope changes can lead to cost overruns, impacting your operations and finance teams and their projects budgets.

Many of the customers who opted for signing up on a tool like Beebole told us their reason was to keep track of billable hours to avoid further underestimation of project costs, which was leading them to financial losses.

Indeed, effective contractor management and time tracking will help with a number of these issues. However, some contractors will be resistant to using a tracking tool. Oftentimes, this opposition stems from concerns about privacy and ease of use. Companies must weigh the costs and benefits of using tools that take screenshots or track location and keystrokes (intrusive features that Beebole doesn’t offer). It is also helpful to inform workers and ensure them that their information will be safe. If you require independent contractors to use a tool, they have a right to understand how it works.

Reminder: Ensuring your time tracking software for contractors is legally compliant

You may have never stopped to consider whether or not your company’s timekeeping for contractors is actually legally compliant. First, bear in mind that it is not technically legal to schedule independent contractors. You can negotiate bids and reach agreements about timing and deadlines, but you may not dictate the working hours of a contractor. It is, of course, permissible to pay freelancers by the hour and to track that time. However, the way time is tracked may also be regulated.

Many countries already have time tracking or employee monitoring legislation on the books. It should also be noted that often includes time tracking for remote teams. Most recently, the Court of Justice of the European Union ruled to make employee time tracking mandatory in all member states. It’s difficult to say if the ruling applies to timesheets for independent contractors, as the specifics are left up to each nation. Employers should keep an eye out for new and relevant legislation in the coming years.

Simplifying independent contractor time tracking

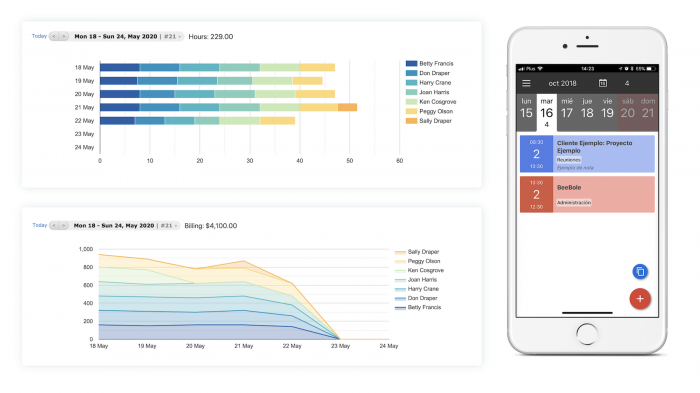

When it comes to ease of use, features like automated reminders, an intuitive interface, and flexible mobile time tracking all help. Beebole offers all of these features, and a mobile app that syncs automatically and works offline, for easy time tracking anywhere. Time entry may be done by manually entering a start and end time, or using a timer. Contractors can submit hours for approval, including comments about the work. Finally, when adding a worker to the platform you may categorize them as an employee or a contractor, and configure group permissions accordingly.

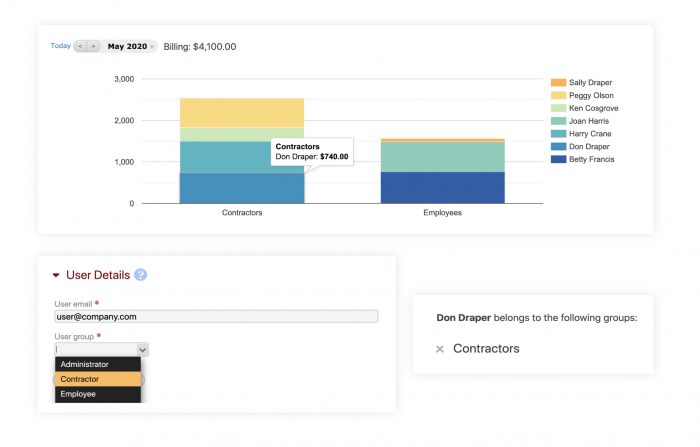

Given the nature of their work, when tracking time, independent contractors are usually more inclined to view reports of hours worked and billing or invoices. Beebole has highly customizable reports on time spent, budgets, and much more. Managers can build custom KPI dashboards and set permissions for each one, assigning reports to specific types of users. You can distinguish between billable and non-billable time, and set billing rates by worker, task, project, or client to ensure accurate invoicing. Beebole makes contractor payments and pay reports easy. Export and share professional invoices, or integrate with your company’s payroll software to bill confidently.

While absences are usually irrelevant for contractors, it is important to manage their availability. With Beebole, future hours can be entered, or scheduled, and later modified to reflect the time actually worked. You can also create an “absence” category that workers may use to indicate their future availability. These seemingly simple capabilities can make a big difference when managing contractors. When freelancers can count on reliable client reporting and accurate hours, and feel confident they will get paid fairly, it’s a win-win for all parties.

Why companies use Beebole for contractor time tracking

- Mobile app with offline mode for iOS and Android

- Classify people by type (contractors, employees, project managers, etc.)

- Create user groups to filter reports and configure permissions for contractors

- The simple interface means you’ll save time onboarding

- Quickly approve, reject, and lock hours in bulk

- Set costs and billing rates for individuals, or by project or client

- Send automated reminders

- Use absences to show future availability

- Exportable, sharable reports on time, costs, billing, and more

- Create personalized and professional invoices

Companies in more than 60 countries are already using Beebole to track independent contractor time (here’s a real example of time tracking for IT consultants). They range from freelancers to multinationals across sectors like marketing, construction, banking, civil engineering, design, and much more.

Enhanced accountability and cost control: time tracking for contractors

In the short term, your motivation for tracking contractor time may be solely about billing.

In the long term, purposeful and well-organized time tracking will generate numerous other benefits for your business. Having a clear overview of contractors’ availability, project status, and budgeting makes for more efficient management and resource allocation. While you don’t necessarily need to calculate the cost of an employee in this particular case, understanding what’s spent on independent contractors vs. what’s delivered is key. What’s more, having an accurate record of contract time can be invaluable in the case of an audit or dispute. The business intelligence and peace of mind you’ll gain with tools made for independent contractor time tracking like Beebole will allow you to focus on long term strategy and growing your business.

Better Manage Your Contractor Workforce

—

Photo by Leon Seibert on Unsplash

Comments

Related posts

How to calculate project profitability using time tracking data: Everything you need to know [Excel tutorial]

Published: 2022/7/19 | Andrew ChildressIf you bill clients based on the time you spend, here’s a pop quiz: which projects make the most money? Or even more importantly: which projects aren’t profitable? If you don’t know the answer to these questions, it’s time to start thinking about project profitability, a measurement of revenue billed versus time and cost expended. […]

Transforming forecasting and risk management: A practical guide to xP&A implementation

Published: 2025/4/15 | Carlos QuintanaIn today’s rapidly evolving business landscape, organizations face an increasingly complex challenge: how to maintain accurate forecasting and effective risk management while navigating unprecedented levels of uncertainty. As US Economist Michael Hammer wisely noted, “The secret of success is not to predict the future but to create an organization which can prosper in an unpredictable […]

“Automation for finance and accounting is a must.” An interview with Packlink’s CFO.

Published: 2019/11/14 | Helen PoliquinFor Noelia Podadera, Chief Financial Officer at Packlink, big data and automation for finance are keys to competing in the high-growth delivery industry. She shares these and other insights in this instalment of The CFO Journal, a series featuring financial leaders from around the world. Who is Noelia Podadera? Where: Packlink is an online shipping […]

![How to calculate project profitability using time tracking data: Everything you need to know [Excel tutorial]](https://beebole.com/blog/wp-content/uploads/2021/09/starter-dashboard-project-profitability-700x436.jpg)

Fantastic insights on time tracking for independent contractors! Your blog provides a thorough understanding of its importance and practical tips for effective implementation. I appreciate the clarity and real-world examples that make it easy for independent contractors to optimize their time management. Thanks for sharing such valuable information!