Project cost control made easy: Mastering budget to actual variance analysis

Table of Contents

Table of Contents

To deliver a product or service within a specified time and budget you have to juggle a variety of activities, responsibilities, and stakeholders. Estimating the project’s cost and keeping tabs on actual spending are two crucial aspects for project managers. Budget to actual variance analysis is the comparison of the budgeted and the actual cost of the project as it progresses.

A budget is a financial blueprint or a roadmap of how a project is expected to materialize over its lifetime. It provides a basis for monitoring and controlling project expenses.

Budgeting involves financial planning and creating an estimate of the associated project costs. That could include costs like materials, labor costs, equipment, and overhead and then comparing these estimates to the amount of funding available. This ensures the project can be completed within the available time and financial constraints.

Budget is also an essential tool for both project managers and finance teams to assess the financial viability of a project. It helps identify potential cost overruns before they occur. This ensures efficient and effective use of resources.

Let’s say we are working with a company in technology business operations among other high growth companies. And we are looking at a mobile application development project. We have a team of four people working on this project, including a project manager, a frontend developer, a backend developer, and a designer. Let’s say this is a six-month project.

We can do some rough financial modeling and come up with an estimate of the time each team member will spend on this project.

The hourly rate for each of the roles is as below:

By multiplying the estimated hours with the hourly rate, we come up with the budgeted cost for the project as below.

In the above example, the estimated or budgeted cost of the project is roughly ~$50K.

Actual are the costs spent on a project as it progresses. It measures the real cost of the project. While doing the budget vs. actual variance analysis, we can then compare the budget to the real cost to see if the project is on track. In the above example, the team ultimately spent more time than anticipated on several roles.

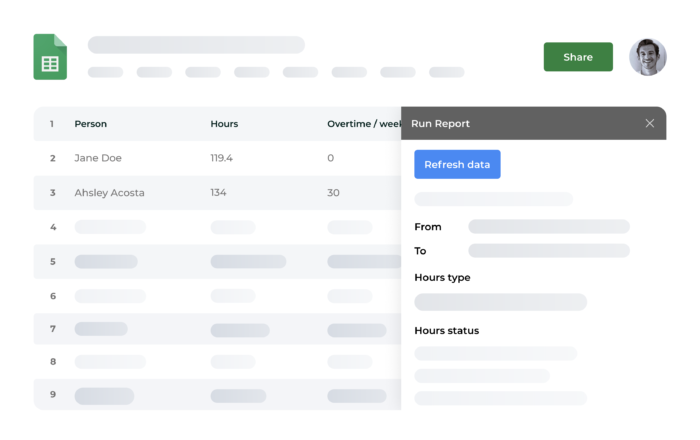

With Beebole you can capture the actuals with the final cost and compare that to what was originally planned. Incorporate this data directly into Excel or Google Sheets and you can easily tackle the budget vs. actual analysis.

Beebole’s add-in for Microsoft Excel helps you access powerful, customizable timesheet reports for better insight into your employee time tracking data. Here are few reasons you might want to give it a try:

If Google is more your style, you might consider the add-on for Google Sheets, which allows you to easily access and organize your time data in Google Sheets. Here are some of the benefits of syncing your time tracking data with this add-on:

Budget to actual variance analysis comes in handy when you need to understand how or why your budget is off. For example: The hourly rates you’d budgeted for have changed. Instead of what was estimated above, take a look at what the real hourly rates turned out to be:

Next, let’s calculate the actual amount spent on the project at the end of the six months. By multiplying the actual hours with the actual rate, we get the actual cost for the project as shown below.

In the above example, the actual cost of the project is roughly ~$56.6K, which is obviously a different number than the budgeted $50k.

Beebole removes the guesswork, pinpointing exactly when and where things go off track.

A budget variance is the difference between the budgeted amount and the actual amount. It is calculated by subtracting the budgeted amount from the actual amount. Depending on whether the actual numbers are higher or lower than the budgeted amount. It can be expressed as a positive or negative number.

Whether positive variance or negative variance, it’s important to analyze the reasons for variances. This helps decision makers identify areas for improvement and better decision making for future budgeting.

Accurate forecasting and tracking of budget vs. actual provides a clear picture of the financial performance of the project, the department, and organization as a whole. So what’s the difference between budgeting to forecasting? Budgeting involves planning and allocating resources for a specific period, while forecasting involves predicting future outcomes based on past data and current trends.

It allows project managers to identify and address any cost overruns or inefficiencies. This information also helps to make informed decisions to bring the project back on track. Accurate tracking also ensures that the project remains on schedule and within budget. Plus, it also helps to find cost savings and resource optimization opportunities, which is obviously critical for any project managers or finance teams using this information.

Let’s take a deeper look at why understanding your budget vs. actuals is important:

This is critical for stakeholders, as it helps assess the financial viability of the project. It also makes room for informed decisions about future projects. The analysis allows project managers to find patterns and trends in the actual costs. They can then make more accurate cost estimates for future projects.

Variances are an equally important indicator of project performance. It helps identify areas where the project is underperforming or over-performing. This data or information allows project managers to make informed decisions about how the project can be adapted to meet the budget and cash flow.

By providing stakeholders with accurate and up-to-date information about project finances, project managers and finance teams can build trust and confidence with their team, sponsors, and other stakeholders.

The formula for variance in budget vs. actual depends on the context and the data or information being analyzed. Variance in budget versus actual refers to the difference between the budgeted amount and the actual amount spent in a given period. And it can be used to assess performance and identify areas where adjustments may be needed.

Variance = Actual amount – Budgeted amount

Continuing with our example, here is a snapshot of actuals vs. budget variance analysis:

We had estimated about 570 hours of time and $5,100 as the total projected cost of the project. Turns out we ended up spending 635 hours and $56,640. That means that we overran our initial estimate by 65 hours and $6,500.

Let’s analyze budget vs. actual to figure out what caused this overrun:

Overall, the backend developer ended up spending 360 hours on the project vs. the 300 hours estimated. Similarly, the product designer spent 85 hours vs. the budgeted 60 hours.

Here are the budgeted hourly rates that were uploaded in Beebole.

And here are the actual hourly rates that were logged in Beebole.

We ended up paying $160/hour to the project manager vs. $150/hour in the budget. Similarly, for the project manager we spent $120/hour vs. the $100/hour in the budget.

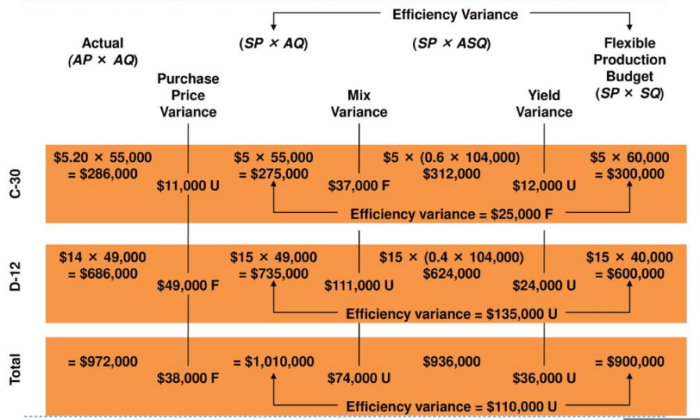

To explain the variances, one can break it down into two components: Rate and Volume. Let’s have a deeper look:

This reflects the difference between the actual cost or actual revenue per unit and the budgeted cost or revenue per unit. The formula for price variance is:

Rate variance Formula = (Actual Rate – Budgeted Rate) x Actual Time spent

This reflects the difference between the actual time and the budgeted time. The formula for volume variance is:

Volume variance Formula = (Actual Time – Budgeted Time) x Budgeted Rate

Of the $6,500 total variance, the difference of $2,450 results from a change in the rate ($/hr). While the remaining $4,050 is the result of more time spent on the project.

Next let’s take a look at how to prepare an Actual to Budget Variance analysis report.

A budget variance analysis report follows a standard structure, including the following:

Start your budget variance report with a brief introduction of the findings and its purpose. It should explain what the report is about and why it matters.

The summary provides an overview of the budgeted amounts and the actual results.

It includes the budget amount and actual expenses for each line item, as well as the percentage variances. We can use tables or graphs to present the information in a clear and concise way.

This section breaks down the variances into its components.

This could be price variance, quantity variance, mix variance, and volume variance. Again, try using tables or graphs to present the information.

Here we analyze the variance to identify the factors that contributed to the difference. We also determine the reasons for the variance, like whether the variance is favorable budget variance or unfavorable budget variance. Provide supporting evidence and examples to illustrate your analysis.

Based on the analysis, we can provide recommendations for action to address the variances. This is a chance to identify specific actions that can be taken to improve performance or specify anything else that can be done to achieve better results in the future. We explain how each recommendation can close the gap between budgeted and actual amounts.

Finally, here we summarize the key points of the report. Also, we emphasize the importance of taking action to improve performance. And provide a clear call to action and encourage stakeholders to implement the recommendations.

These include any supporting information, such as tables, graphs, or detailed calculations and financial statements. It specifies instructions on how often to run a Budget to Actuals report, and it also shares guidelines and tips on Budget vs. actuals: how to control variance.

The appendices should be well-organized and easy to understand. When writing the report, we must keep in mind the audience and their expertise level. We should also use clear and concise language, and avoid technical jargon (unless it is absolutely necessary.) Don’t forget that the use of visuals, such as tables and graphs, helps explain complex information. Finally, proofread the report carefully to ensure it is error-free and well-structured.

We hope that after reading this article you feel well-versed in the differences between budgets and actuals, and what a budget vs. actual variance is. Furthermore, we hope you can take that information and not only understand when it’s favorable and unfavorable variances. But how to present this information to stakeholders, finance teams, and more.

Budget to actual analysis is a critical aspect of the project management team. It helps project managers assess the financial viability of their projects and control fixed costs and variable costs by monitoring and analyzing expense variances between actual and budgeted costs. When done properly and efficiently, project managers can identify inefficiencies, make necessary adjustments, and ensure project success.

—

Photo by firmbee.com on Unsplash

If you’re remotely interested in project management, then you’ll likely be quite familiar with the scope-budget-time project management triangle. As with many tried-and-true ideas and theories, sometimes it can be good to hit refresh and come at it from a new angle. And that’s what I’d like to do today—let’s have a look at the […]

Today we’re diving right into overtime cost analysis. Fixed costs, such as rent, insurance, and salaries for regular full-time employees, are a way of life for companies. These expenses remain constant regardless of changes in demand, production levels, or sales volume. But what about variable costs or expenses that change depending on demand, production levels, […]

Project budget variance reports are invaluable tools, but how to communicate budget variance and turn the information into strategic actions? Budget variance reports’ true worth lies in how the insights they provide are used across the organization. If such insights can’t influence strategic changes, variance reports are limited to control and accountability functions. To ensure […]