The true cost of employees: Calculate employee cost with this labor cost spreadsheet

Table of Contents

Table of Contents

Understanding the true cost of employees is crucial for any business looking to manage resources effectively. That’s why we’ve created this free spreadsheet download and video tutorial with detailed instructions and formulas to easily calculate employee cost at your company, as well as to forecast new hires. It’s more than just base salaries; it encapsulates a variety of associated expenses. It’s key to understand that employers pay more than just the salaries of their employees. Here we’ll explore the main variables to help calculate the actual annual cost of your workforce.

We’ll help you analyze these costs in-depth, shedding light on the full financial impact employees have on an organization’s bottom line.

Note: How much does an employee cost? This article addresses some of the primary considerations you need to know when hiring someone in the private sector in the United States.

Some of the information you will find here is easily adaptable to other countries, like social security related expenses. Our particular case is based on salaried employees as opposed to hourly rate workers. While many employers and institutions (including the Bureau of Labor Statistics of the U.S. Department of Labor) prefer to work around hours rather than salaries, we have opted for the latter to give you a better idea of the real annual costs of your employees.

Calculating your labor rates is a complex exercise that requires a careful examination of different variables like the industry you belong to, the type and characteristics of the role you are planning to cover, the location of your company, and the kind of benefits and legal expenses you are willing and required to pay for that employee. While this may be intimidating at first, there are some basic variables that will always affect your labor rates. We will explore those variables so you can better calculate the potential costs posed by a new hire.

The base salary in the U.S. is the fixed amount of money an employee gets before any extras are added or taken off. It doesn’t include bonuses, overtime, or any other potential compensation from the employer. It’s often paid out in yearly or monthly terms, and can vary widely based on the role, industry, and location.

Let’s start our example: If you want to hire someone on a salary of, say, $30,000 a year, you need to be prepared to pay much more than that. In addition to the base salary, you need to cover other things like employment taxes and benefits (e.g. health insurance, 401(k)). While this calculation is complex, there are some simple formulas we can use to have an idea of the actual annual cost of an employee. We chose the following 2.

Let’s start with Joe Hadzima, a Senior Lecturer at MIT who provides a simple formula to calculate the actual cost of an employee. According to Hadzima, once you have taken into consideration basic salary, taxes, and benefits, the actual costs of your employees are typically somewhere between 1.25 to 1.4 times the base salary. In other words, an employee earning $30,000 will cost you somewhere between $37,500 and $42,000.

Similarly, and while trying to answer the question, “How much does an employee really cost?” CNN’s reporter Jose Pagliery said that the real salary of an employee ends up “being 18% to 26% more than a worker’s base salary.” That said, let’s take the formulas we have just mentioned and see how they work for specific salaries:

| How much should I pay for an employee? | ||

| Employee’s base salary | Real annual cost per employee Hadzima (1.25 to 1.4 times of base salary) |

Real annual cost per employee Pagliery (18% to 26% more than base salary) |

| $30,000 | $37,500/42,000 | $35,400/$37,800 |

| $40,000 | $50,000/56,000 | $47,200/50,400 |

| $50,000 | $62,500/70,000 | $59,000/63,000 |

| $60,000 | $75,000/84,000 | $70,800/75,600 |

| $70,000 | $87,500/98,000 | $82,600/88,200 |

| $80,000 | $100,000/112,000 | $94,400/100,800 |

| $90,000 | $112,500/126,000 | $106,200/113,400 |

| $100,000 | $125,000/140,000 | $118,000/126,000 |

As we can see, the two formulas provide similar numbers that we can take as an idea of the potential cost of a new hire. However, we will now explore the essential ingredients you need to know in order to calculate your labor costs. We will come back to these numbers to see how they compare with our findings.

The cost of employee benefits is often referred to as “benefit expense” or “employee benefits expense.” These terms refer to the total cost that a company incurs to provide benefits such as health insurance, retirement contributions, tuition reimbursement, paid time off, and other perks to its employees. The expense is a significant portion of an employee’s total compensation, beyond their base salary.

The base salary is affected by some of the factors we mentioned at the beginning of this article. Location, for instance, affects salaries in a decisive way even if we are considering the same role. Costs of living are the main drive, as you can see from the following chart we created using the cost of living calculator from CNNMoney.

| From / To | Miami | San Antonio | New York | Denver | San Francisco |

| Miami | $40,000 | $30,769 | $83,322 | $39,091 | $67,343 |

| San Antonio | $52,000 | $40,000 | $108,318 | $50,818 | $87,545 |

| New York | $19,203 | $14,771 | $40,000 | $18,766 | $32,329 |

| Denver | $40,930 | $31,485 | $85,259 | $40,000 | $68,909 |

| San Francisco | $23,759 | $18,276 | $49,491 | $23,219 | $40,000 |

Based on the above, if you live in Miami with a salary of $40,000, a comparable salary in Manhattan would be around $83,322 just because the costs of living in New York City are much higher than in the Miami-Dade County area. However, a comparable salary in San Antonio, Texas, where the cost of living is lower than in Miami, would be around $30,769. Again, this calculator is useful in terms of providing an indication of how your salary will compare in different cities across the country, taking into consideration things like housing, groceries, utilities, transportation, and health care.

Several factors can affect the base salary of an employee in the U.S., including:

Sometimes, a combination of those factors can create huge salary differences even among people with the same role. The following chart based on the percentiles and wage differences illustration from the Bureau of Labor Statistics exemplifies this issue for commercial pilots.

| Percentile wages and wage difference for commercial pilots, May 2014 |

||

| 10th percentile (10% made less, 90% made more | 50th percentile: Median (50% made less, 50% made more) | 90th percentile (90% made less, 10% made more |

| $32,500 | $75,620 | $141,210 |

| Wage difference between 10th percentile and 90th percentile: $105,960 | ||

Remember: You can download a free spreadsheet with all of the formulas included in this article here.

Every employer in the U.S. needs to pay taxes and unemployment insurance for their employees. Companies are required by law to cover social security, Medicare as well as state and federal taxes. Let’s look at it in detail.

The FICA tax is a mandatory payroll deduction that serves to cover Social Security and Medicare. The employer needs to cover 6.20% for Social Security and 1.45% for Medicare.

Employers need to pay for both the Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA). As far as FUTA goes, companies are only required to pay 6% of taxes for the first $7,000 earned by any employee. That said, most companies will pay $420 annually to cover federal unemployment. The only exception to that rule is California, where companies need to pay 2.1% or $147 annually.

On the other hand, SUTA (sometimes also referred to as SUI – State Unemployment Insurance) is calculated in a different way and can change significantly across states. Generally speaking, however, SUTA oscillates between 2.7% and 3.4%.

In order to insure employees against injuries, every employer needs to pay for workers’ compensation. Considering that risks are highly different among industries and specific jobs, this cost varies a lot. To calculate workers’ comp, each type of job is covered with a specific rate for every $100 of salary. The following numbers from the National Council on Compensation Insurance (NCCI) illustrate how workers’ comp is calculated across different jobs:-

| Description | Class code | Rate per $100 | Base salary | Cost/Employee |

| Clerical/Office | 8810 | $0.12 | $28,000 | $33.60 |

| Landscaping | 0042 | $6.94 | $36,000 | $2,498.40 |

| Retail Store | 8017 | $1.33 | $30,000 | $399.00 |

| Medical Office | 8832 | $0.3 | $40,000 | $120.00 |

| Restaurant | 9082 | $1.50 | $30,000 | $450.00 |

| Painter | 5474 | $8.99 | $32,000 | $2,876.80 |

If you notice, workers’ comp for jobs where injuries are more common is a lot higher. Having said that, we can figure out now how much an employer needs to pay for Social Security, Medicare, federal and unemployment insurance, and workers’ comp. Let’s see the details in the following chart, assuming a 3% rate of SUTA and $0.12 for workers’ comp:

| Type of cost | Percentage of employee’s base salary | Base salary $30,000 |

Base salary $70,000 |

| FICA Social Security | 6.2% | $1,860 | $4,340 |

| FICA Medicare | 1.45% | $435 | $1,015 |

| Unemployment insurance FUTA | 6% of first $7,000 | $420 | $420 |

| Unemployment insurance SUTA | 2.7%-3.4% | $900 | $2,100 |

| Workers’ Comp | $0.12 for each $100 of wages | $36 | $84 |

| Total | – | $3,651 | $7,959 |

Now that we understand this, let’s see some of the standard benefits employees usually get in the private sector.

Besides Medicare, most companies offer private health insurance to their employees. In fact, health insurance represents the highest cost of all benefits. According to data discussed by Hadzima, health insurance for an employee making $50,000 a year will cost between $2,000-$3,000 (single employees) and $6,000-$7,000 (for families). Similarly, Christina Merhar, Senior Editor for Zane Benefits, states that the yearly amount an employer pays for health insurance in the U.S. runs between $5,000 and $12,000.

Besides health insurance, many companies also offer life insurance (around $150 on the first $50,000 of your wages) and long-term disability insurance (approximately $250 per year). Next to all this, dental insurance is one of the most popular benefits in the private sector.

In general, the cost of dental insurance varies depending on factors like the number of employees, the type of coverage provided, and the location of your business. Generally speaking, dental insurance premiums cost somewhere between $25 to $50 a month, an estimate that fits into the annual cost of $240-$650 that Hadzima assigns to dental insurance.

After health-related insurance, many employers are also willing to cover additional benefits like 401(k) plans, personal devices (laptops, cell phones), and vehicle costs. As far as 401(k) goes, Jose Paglieri states that the “average contribution to 401(k) plans is 2.5% of a worker’s salary.”

Let’s see how all the benefits we have mentioned look for employees with base salaries of $30,000 and $70,000. To give you a better idea, we have picked a specific amount for each cost:

| How much does an employer pay for benefits? | ||

| BASE SALARY | $30,000 | $70,000 |

| Health insurance ($5,000/12,000) | $7,000 | $7,000 |

| Dental ($240/650) | $450 | $450 |

| Life insurance ($150 on $50,000) | $150 | $150 |

| Long term disability insurance ($250) | $250 | $250 |

| 401(k) (2.5% of salary) | $750 | $1,750 |

| Total benefits | $8,600 | $9,600 |

At this point, we have all the variables we need to calculate the annual cost of an employee. Now, we just need to add everything and see what we get. Don’t forget, at the end of this article, we provide a free spreadsheet and video tutorial that will help you quickly and easily complete this process. Let’s take a look at the following chart:

| Annual cost of an employee | ||

| BASE SALARY | $30,000 | $70,000 |

| Total FICA, FUTA, SUTA and workers’ comp | $3,651 | $7,959 |

| Total benefits | $8,600 | $9,600 |

| Total annual cost | $42,251 | $87,559 |

According to our findings, we would need to pay $42,251 for an employee with a base salary of $30,000, which means we need to add to that base salary $12,251 to cover taxes and benefits. That amount is about 40% of the total annual cost, which is pretty close to the upper end that Hadzima ($42,000) estimates for a base salary of $30,000. Pagliery’s higher end ($37,800) is way below that number.

On the other hand, the real annual cost of someone with a base salary of $70,000 would be around $87,559, which means a percentage of 25% of total compensation in taxes and benefits to pay for that employee. That number is almost equal to the lower end of Hadzima’s range ($87,500) and a bit below Pagliery’s higher end ($88,200), which confirms the fact that the higher the salary, the lower the percentage employers end up paying on top of the base salary.

Hidden costs: Beyond the obvious salary and benefits, there are many less-visible costs. These include onboarding and training costs, equipment and software expenses, and costs associated with managing employee turnover.

Overhead allocation: Depending on the company structure, a portion of overhead costs like rent, utilities, and administrative staff salaries are often allocated per employee. These indirect costs can significantly add to the total cost of an employee.

Opportunity costs: Time spent on hiring, training, and managing employees could be used for other revenue-generating activities. This opportunity cost, though intangible, can impact the overall cost calculation of an employee.

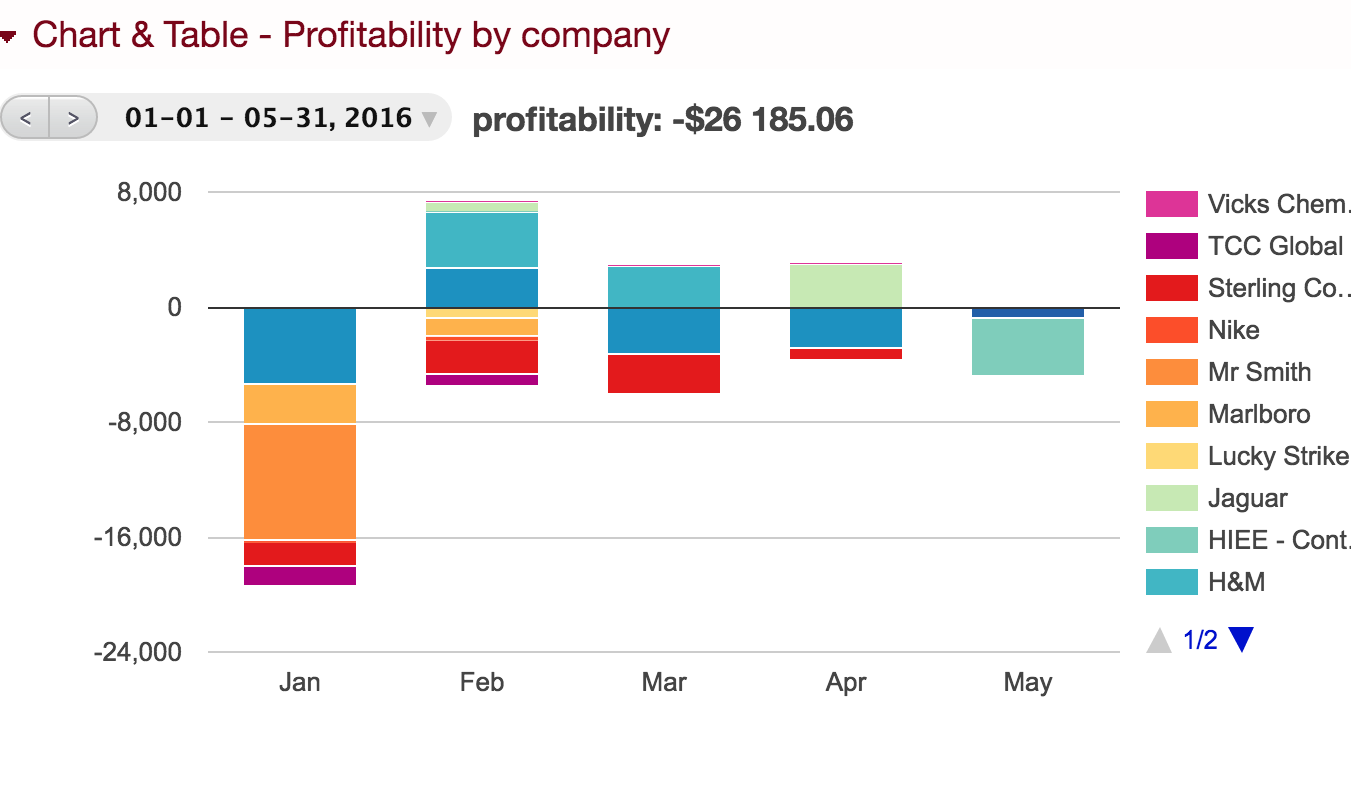

Accurately calculating employee costs is not just a good hiring practice; it’s an essential budgeting task. Once you have a clear idea of each employee’s costs, this data can be integrated into your business intelligence tools, helping you to effectively track and budget projects and clients. Beebole’s Standard Cost module, for example, allows you to assign an hourly cost for each employee, which will then be used in the tool’s reports on budgeting and profitability.

Why is this important to companies using tools like ours? Because managers can monitor the costs and profitability of certain clients or projects in real time to ensure they never go over budget, and identify where the money sucks are. Of course, in order to reach an hourly figure, you’ll first need to use our tips from above to calculate the total cost for that employee.

Insights gained from incorporating your employees’ costs into your business intelligence are sure to save you time and money in the long run.

Furthermore, having a clear understanding of everything that goes into maintaining an employee may change the way you look at your human capital. Nevertheless, while substantial, these costs shouldn’t be viewed as an unfair burden on your company, as investing in your workforce is key to sustaining a successful business.

Please let us know your thoughts, suggestions, or corrections. Thank you!

We have created a free Excel template for you with all the formulas you need to calculate the costs of your employees. Please fill out the form below to receive your free spreadsheet!

Watch our screencast below to see exactly how to use our template.

If you bill clients based on the time you spend, here’s a pop quiz: which projects make the most money? Or even more importantly: which projects aren’t profitable? If you don’t know the answer to these questions, it’s time to start thinking about project profitability, a measurement of revenue billed versus time and cost expended. […]

For Noelia Podadera, Chief Financial Officer at Packlink, big data and automation for finance are keys to competing in the high-growth delivery industry. She shares these and other insights in this instalment of The CFO Journal, a series featuring financial leaders from around the world. Who is Noelia Podadera? Where: Packlink is an online shipping […]

In this tutorial, learn how to create a budget vs. actuals report in Excel using Power Query. Gain insights and track financial performance effortlessly. As a financial controller, accountant, or CFO, you’re likely familiar with the concept of budget vs. actuals. You know that reporting budget vs. actuals can be both cumbersome and time-consuming, given […]

Would you include the costs of seminars/training?

Hi Cherie

Yes, in our opinion, and according to what we know from many of our customers at BeeBole: training is part of the compensation package, so it could be indeed part of an employee cost.

Thank you for reading us

Elena

I thought it was very interesting that you explained that a normal employer usually pays about 5,000 to 12,000 in yearly benefits. My business has grown a lot in the past few months and I find myself in need to hire exterior employees to help out, but I need to find the right benefits to give them. I think it would be fantastic to find a plan that would work with everyone that I hire.

Those workers comp numbers are missing a couple of zeroes under “binding costs”…

Maybe not – just in my industry those costs are far higher…

for FUTA: 6% of $7,000 is $420, not $42

Hi Mike. You are right. Thanks a lot for pointing that out. Best!

Determining the proper wage or cost of hiring a new employee is not easy, which is discussed here. To solve these problems, people turn to experts. Helpful articles like this session might prove a help for everyone.

I just started reading this article, so more may follow, but please examine the first chart: “How much should I pay for an employee?” The second column, Pagliery, is calculated incorrectly. The multipliers should be 1.18 and 1.26. You used +21.95% and +35.13%. That is why the two formulas seem to provide similar results. In reality, the highest end of Pagliery (+26%) should be within 1% of the lowest end of Hadzima (+25%). The difference between the low end of Pagliery and the high end of Hadzima differ by 22%. That is not even close. There were two data entry errors on your spreadsheet.

Hi Chris,

Thank you very much for your comment. You were totally right and we have updated the article accordingly. Best!

What about vacation/pto?

Hi Jill,

Thank you very much for your comment!

We didn’t consider PTO in our article for two reasons:

First, PTO is not required by federal or state law.

Second, you pay the same cost to a salaried employee regardless of how much PTO they are entitled for under contract. Whether it is one week or 2 months, the cost for the company is the same.

Best,

Carlos

Thank you for this brief explanation Carlos. Greatly appreciated.

I agree with the calculation above. In thinking about the salary of employee, we should put into consideration everything from basic to the benefits and other things that the company offered. Thank you for sharing.

This is great, however we are in 2024 and I am sure there is a way to change the dates but I can’t figure it out. Also it doesn’t take into account actual start dates. Is there a way to get that calculation in for current employees so that the employee calculation is more accurate. Finally, I would have liked to have seen the formulas to understand the numbers.

Great article! Understanding the true cost of employees is crucial for budgeting and financial planning. I appreciate the detailed breakdown and the free spreadsheet tool provided. It will definitely help in assessing our workforce expenses more accurately.

Excellent!!

Thank you. Exactly what I was looking for.