What are overtime regulations in the US? Here are the most FAQ

Table of Contents

Table of Contents

Overtime is a foggy concept in an age when more than 50% of employees work remotely at least 2.5 days a week. Technology makes it difficult to fully disconnect, and struggling minimum wage workers are eager to take on extra hours. Nevertheless, even if an employee willingly stays late or answers emails on a Sunday it doesn’t mean these practices are legal or beneficial. Study the overtime regulations in your state, and think about the impact extra hours have on employees’ well-being and productivity. Here are some questions to consider.

Federal overtime provisions in the United States are included in the Fair Labor Standards Act (FLSA). Generally, overtime in the US is paid for any hours worked over 40 in a single week, at a rate of “time and a half”, or 150% of the usual hourly wage.

Several states do have their own overtime laws. The Fair Labor Standards Act (FLSA) simply sets minimum standards. When state and federal laws differ, whichever law is most favorable for employees prevails. If an employee is elegible for overtime pay under state law, but not the FLSA, then the former will apply. Specifically, Pennsylvania, Kentucky, Michigan, Minnesota, Texas, Colorado, Montana, Nevada, and California have their own labor and overtime laws. Other states, such as West Virginia, Wisconsin, New Mexico, Oregon and Alaska have notable changes or exemptions.

Generally, most differences in state laws are related to exemptions, such as those that exempt first responders from earning overtime. 18 states limit the number of overtime hours that health care professionals may work. Finally, some states allow employees to take compensatory time instead of overtime pay if they prefer. Managers should carefully consult their state regulations, as there are many subtle distinctions. Even a seemingly small difference could significantly impact costs and open a company up to liability.

If your business is covered by the FLSA or state overtime laws, then your employees are entitled to overtime. However, the FLSA also lays out some exemptions, the most common of which include independent contractors, volunteer workers, certain computer specialists, and salaried executive, administrative, and professional employees making at least $684 a week. This is the new minimum established by the US Department of Labor as of September 2019, and is significantly less than the $913 minimum proposed by the previous administration’s DOL.

Overall, overtime exemptions based on job duties for professional workers are confusing, and often a point of contention. It is important to note that exemptions are not based on job titles, but rather on specific duties and payment. There are different conditions for an executive, administrative worker, computer specialist, or professional to be exempt, respectively. Office employees making $100,000 or more a year are also exempt. It is important to check state laws, as they differ on specific exemptions. What’s more, when hiring or promoting, be clear about exemptions and expectations for overtime.

Employees covered by the FLSA must receive overtime pay for all hours worked over 40 in a workweek. These limits apply on a workweek basis and employers cannot average hours over two weeks. However, a workweek does not need to coincide with a calendar week. A workweek is any recurring period of 168 hours, or seven consecutive 24-hour periods.

Alaska, Nevada, and California also have daily overtime regulations that require overtime pay for time worked over 8 hours in a day. In Colorado, daily overtime applies to time worked over 12 hours. California and Kentucky also have “seventh consecutive day” laws. These require overtime pay for all hours worked on the seventh consecutive working day, regardless of the number of hours worked in the previous six days.

Whether or not time spent on breaks, travel, training, and other similar activities is actually “working time” is laid out in 29 CFR § 785. For example, it is working time when an employee is on-call away from the office in a way that “he cannot use the time effectively for his own purposes”. After hours training or lectures, if directly related to the employee’s job, are also working time. The business and its workers should negotiate how to track such time.

The Fair Labor Standards Act (FLSA) does not consider work on Saturdays, Sundays, or holidays to be overtime. However, overtime worked on these days is compensated the same as all other overtime. Some states, like Massachusetts and Rhode Island, do require overtime pay for certain retail workers on Sundays and holidays.

There is no overtime for certain positions, such as independent contractors, volunteer workers, certain computer specialists, office workers making more than $100,000 a year, and salaried executive, administrative, and professional employees making at least $684 a week. In general, there is no limit to how many hours an employee can work in a week as long as they are appropriately compensated.

Yes and no; an employer can reduce or withhold hours, but not pay. Employers cannot alter timesheets or refuse to pay overtime by prohibiting unauthorized extra hours. This is true even if workers are notified of this policy in advance. However, an employer can enforce these policies with other disciplinary action such as write ups or suspension.

Establish a formal policy that employees must stick to their scheduled working hours, and clearly communicate it to your workers. An employer also has the right to reduce hours if they see that an employee is nearing overtime for that week. On the other hand, employees cannot be required to sign inaccurate timesheets or to clock out at lunch if they are actually working through these breaks.

Generally, it is not illegal for a business to require employees to work overtime, with adequate compensation. However, there are some exceptions. The FLSA sets limits for certain safety-sensitive occupations, such as pilots, truckers, and railroad workers. Many states also have laws restricting mandatory overtime for certain professions. Currently, 18 states limit hours for health care workers.

Finally, unions and individuals can negotiate collective bargaining agreements or contracts that limit hours. While employees can reach contractural agreements to limit overtime hours, pay for any overtime that is worked cannot be waived. If no such agreement exists, or if an employee is not included in any of the aforementioned exceptions, an employer can make overtime a condition of continued employment.

In the United States, the overtime premium is 50% of an employee’s normal hourly wage. In other words, an employee must earn “time and a half” for each overtime hour worked. Overtime is calculated on a weekly basis, and is applied to any time worked over 40 hours in a single week.

In certain states an employee can choose to take compensatory time rather than overtime time. Other states, including Alaska, Nevada, California, and Colorado also have daily overtime limits. Like normal wages, overtime may be paid in cash as long as it is reported and reflected in employees’ W-2s. It is a common misconception that the tax rate for overtime pay is higher. However, if an employee works enough overtime in a year, they may find themselves in a higher tax bracket.

The scope and nuance of differences in labor laws across countries makes it impossible to cover them all here. In the case of the European Union, EU directives establish certain minimum requirements upon which individual nations can expand. These directives state that employees cannot work more than 48 hours a week on average over a 4 month period. Workers must have 11 consecutive hours of rest each day, and at least 24 hours of uninterrupted rest every 7 days over a period of 2 weeks. Those working more than 6 hours a day must be given a break.

Employees without measured or predetermined working hours, such as executives, may be exempt from certain obligations. Companies may also reach formal agreements with employees to work more than the 48 hour weekly maximum. Finally, in the EU employees reserve the right to revoke consent to any such agreements.

The European Court of Justice recently ruled that EU employers must implement time tracking systems to ensure compliance with labor laws. The specifics of implementation are up to the member states, but the systems must be “objective, accessible, and reliable”. The ruling stems from a lawsuit against Deutsche Bank in Spain, where mandatory employee time tracking has already been implemented with the goal of regulating unpaid overtime.

As a time tracking company, we get a lot of questions about how to reliably track overtime. While there is no single solution for all companies, professions, and regions, Beebole offers features that will allow you to track and create reports on employee overtime.

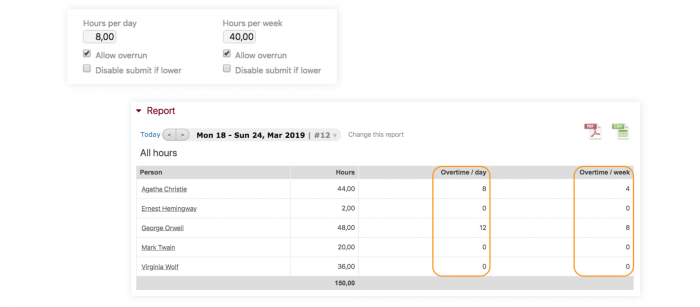

You can modify the maximum number of working hours per week and day, which are 40 and 8 hours, respectively, by default. Overtime hours reports are calculated based on these settings. You can add a daily overtime or weekly overtime column to reports, depending on how your company calculates overtime. Any time worked over the established weekly or daily maximum will appear in these columns.

Alternatively, you can create an “overtime” activity in the account, which would require employees to intentionally track their overtime. This is a good option if you want to count specific hours as overtime (weekends, nights, etc.), rather than the tool calculating hours automatically. If you have more specific overtime tracking needs, let us know and we will work to find the best solution for your company.

—

Photo by @madbyte on Unsplash

This is the second part of a two-part series on process documentation with Vinay Patankar, CEO of Process Street. In case you’re just tuning in, we recommend you read part one Why Documenting Your Processes is Key to Surviving as Remote Business first. Now that you’ve learned the ins and outs of why process documentation […]

Workforce management apps and software are the backbone of any smooth-sailing operation, and everybody knows it. Whether you’re talking business intelligence, employee engagement, expense management, time tracking, or anything else that contributes to the well-oiled machine that is your company, workforce management tools and software are a must at every level, within every sector, and […]

Whether you’ve been managing a remote team for years or are newly embracing a remote-work model, knowing how to build a successful and measurable remote work strategy is key. In this article, we’ll be diving into practical tips for managers to help them navigate managing remote team members while ensuring they’ve got a successful remote […]