Overcome the hidden hurdles of overtime cost analysis with this method

Table of Contents

Table of Contents

Today we’re diving right into overtime cost analysis.

Fixed costs, such as rent, insurance, and salaries for regular full-time employees, are a way of life for companies. These expenses remain constant regardless of changes in demand, production levels, or sales volume. But what about variable costs or expenses that change depending on demand, production levels, and sales volume? How do businesses handle and account for these?

Take overtime expenses, for instance, as one of the most important variable costs companies can experience. If a company sees an increase in demand for its products or services, it may require its employees to work extra hours to meet that demand. In turn, the company incurs additional costs for paying overtime to those employees. Conversely, the opposite can also happen when demand decreases.

Consider the case of OpenAI, the brainchild behind the red-hot chatbot taking the world by storm, ChatGPT.

ChatGPT was in the works for years. But within two months after launching, its monthly active users exploded past 100 million. Those figures made it the fastest-growing consumer application in history.

How could OpenAI keep up with this uncontrollable demand? Could regular 9-5 hours keep up with user growth roughly equal to Egypt’s population?

ChatGPT’s rise is an extreme example. Yet regardless of size or industry, companies that see an increase in demand for their products and services must ramp up their operations to meet higher demand.

The only way to do this is for management to ask employees to work overtime or beyond regular working hours.

Management can always get employees to agree to such a thing by paying them higher wages. That’s the easy part.

The hard part is the analysis.

Let us show you exactly how Beebole can help you.

“The Real Cost of Overtime Is Higher Than You Think” headlined a CNBC article over a decade ago. In 2023, with inflation still soaring and labor costs rising, this statement has never been more relevant.

Overtime cost analysis is straightforward. It’s a financial and managerial accounting tool used to evaluate the cost of employees working beyond their regular working hours. It involves examining the additional expenses incurred by a company when employees work overtime, such as increased salaries, benefits, and operational costs, and comparing these expenses to the benefits gained from the extra work.

The main reason overtime cost analysis is critical is that it helps companies determine the cost-effectiveness of using overtime to increase production or cover unexpected demands. In addition, further insights into overtime cost analysis can help companies identify areas where overtime causes excessive financial strain, analyze employee productivity, better predict and budget for overtime expenses, and ensure compliance with labor laws and regulations.

Moreover, high overtime costs tend to correlate to high turnover rates. Frequently, too much overtime can have employees feeling overworked, demoralized, and disenfranchised.

Simple enough? In theory, it should be. However, overtime cost analysis comes with many challenges and difficulties for companies.

When management has to fetch overtime hours from employees that track these hours, it often comes with manual errors, incomplete or inaccurate time tracking systems, and employees improperly reporting all overtime hours worked.

Determining the appropriate overtime rate is challenging because so many different variables are involved. The first challenge in determining the appropriate overtime rate involves incorporating data from multiple sources like monthly salary and indirect costs like benefits and taxes.

Overtime policies may also differ between different company departments and from state to state. These factors can confuse things, especially with labor laws constantly changing.

Regulatory compliance can be challenging with overtime cost analysis because labor laws and regulations governing overtime pay are complex and vary by jurisdiction.

Employers must carefully track employee work hours and salary. Otherwise, they can face the consequences through legal action, fines, and irreparable reputational damage. For instance, say there’s a company with operations in California and Texas. It will have to account for two very different overtime policies.

California has some of the strictest overtime laws in the country. Its overtime laws govern hours worked over 8 hours a day, 12 hours a day, 40 hours a week, or 7 consecutive days. For instance, for 8+ hours worked a day, employees get 1.5x their regular salary, and for 12 hours, 2x their salary.

On the other hand, Texas‘s only overtime requirements involve paying employees 1.5x their regular salary if they work over 40 hours a week. There are no daily overtime requirements.

If tracking manually, timesheets and attendance reports are difficult to manage and even harder to understand. Often, it’s hard to answer simple questions from these documents, such as what % of overtime pay makes up actual compensation and what are overtime costs per project (or per line, as with manufacturing industries)? This is where using a project time tracking tool can really change the game.

Headcount analysis and overtime cost analysis are closely related tools that can help a company manage its workforce effectively.

Headcount analysis is a method used to evaluate the number of employees in an organization at a specific point in time. It involves counting the number of employees in different departments, job categories, or locations and comparing the results to previous headcount data.

The objective is to understand the current staffing level, identify trends and changes in the workforce over time, the mix of full-time and part-time employees, and the breakdown of employees by job function or location.

Moreover, it’s beneficial for workforce planning, budgeting employment costs, allocating resources, and making informed decisions regarding staffing optimization.

However, like overtime cost analysis, it comes with several challenges.

Ensuring accurate headcount analysis data is incredibly challenging if data is collected manually or from multiple sources.

Headcount analysis is often problematic because it’s hard to keep up with changes in the size and composition of a company’s workforce, primarily if it occurs quickly.

A company’s headcount analysis typically includes part-time employees, contract workers, or seasonal employees. However, this is only sometimes the case. Not all companies define the scope of their headcount analysis the same way.

Headcount analysis can provide misleading figures if there’s no context considered. For example, say business conditions change, new products or services get introduced, and changes in the competitive landscape alter the marketplace. Let’s use ChatGPT as an example again. Microsoft is in talks to acquire 49% of OpenAI, the developer of ChatGPT. Reportedly, they’ve also invested billions in the platform. However, Microsoft simultaneously laid off 10,000 workers. Context is everything.

There is no universally accepted definition of what is a “headcount.” In other words, methods and metrics used in headcount analysis vary widely between companies and industries because they have different business models, organizational structures, and workforce needs.

Calculating overtime costs involves a systematic step-by-step process. By following these steps, you can accurately calculate the total cost of overtime for your employees.

First, determine the applicable overtime rate. To do this, calculate the employee’s regular hourly rate and then decide which one of three standard overtime compensation rates applies- straight time, time and a half, or double time.

Straight time is overtime compensation equal to an employee’s regular wage.

Time and a half is the most common overtime rate and is 1.5x an employee’s regular hourly rate.

Lastly, double time is where an overtime pay rate is double the employee’s regular hourly rate.

Once you determine the overtime rate, calculate the number of hours the employee worked over their regular hours.

Once you know the overtime rate and overtime hours an employee worked, calculate the overtime pay by multiplying the overtime rate by the number of overtime hours worked.

Finally, consider indirect costs such as benefits and taxes, additional supervision, training, equipment usage, and energy and utility costs.

Excel is an excellent tool for accurately and quickly calculating overtime costs. It can help automate the process, reduce errors, and streamline an otherwise daunting process. It’s a clear-cut step-by-step process.

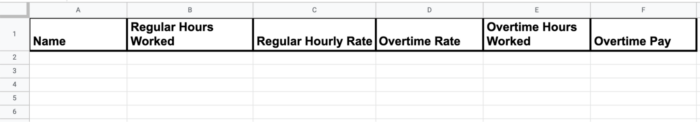

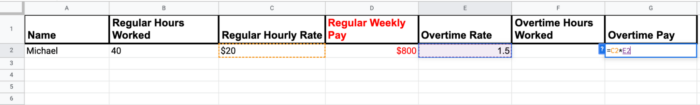

Start by organizing data in a spreadsheet with columns for the employee name, regular hours worked, regular hourly rate, overtime rate, overtime hours worked, and overtime pay.

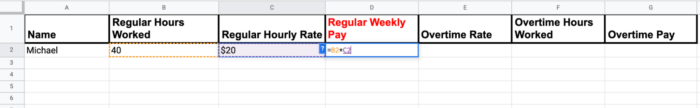

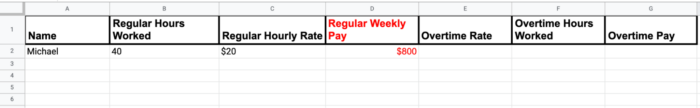

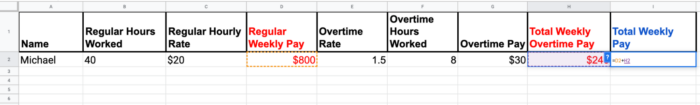

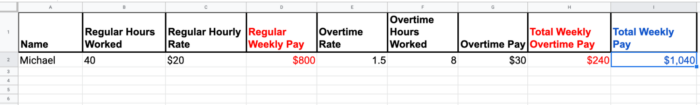

Say an employee named Michael works 40 regular hours weekly at a base salary of $20 per hour. First, start filling in the corresponding columns with these figures. Then add a separate column for “Regular Weekly Pay.” Finally, multiply the regular hours worked by the regular hourly rate to calculate regular pay.

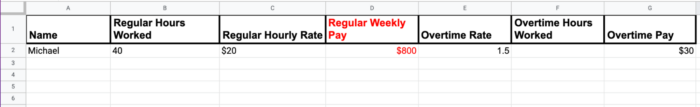

Next, we calculate the overtime pay. In this example, Michael’s overtime rate is according to the time and a half method (1.5x regular rate). So we add 1.5 for the overtime rate cell and calculate overtime pay by multiplying his regular hourly rate by the overtime rate.

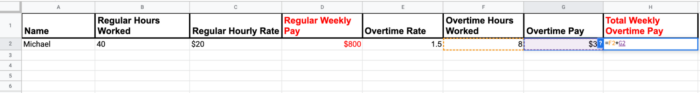

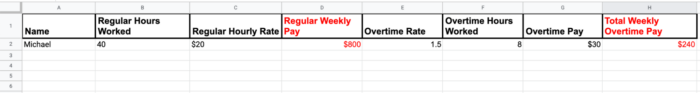

Say Michael worked 8 hours of overtime for the week. First, we’d add 8 in the overtime hours worked cell. Then, we’d create a new column called “total weekly overtime pay.” In this column, we multiply the overtime hours worked by the overtime pay. Once we calculate this, we find Michael made $240 in weekly overtime pay.

Add a final column called “total weekly pay,” and add regular and overtime pay. Because Michael made $800 during the week from his regular salary and $240 in overtime, he had a total weekly salary of $1040.

While Excel can be a helpful tool for overtime cost analysis, it has many shortcomings that make it challenging to manage and analyze data effectively, mainly when dealing with large datasets or complex formulas.

Calculating overtime costs manually in Excel can be time-consuming, especially for large companies with many employees or complex overtime rules.

When you manually input everything related to overtime costs in Excel, you’re prone to human error and incorrectly entering data.

Excel has limited scalability and is sometimes ineffective when dealing with large datasets or complex formulas.

Excel can make it difficult to track changes or audit calculations. Consequently, this makes it challenging to identify errors.

Excel lacks advanced automation features. Without these features, automating repetitive tasks or performing advanced data analysis is difficult.

Excel may not integrate with other systems or software an organization uses, making it challenging to import or export data or share data with other stakeholders.

Because of these weaknesses and inefficiencies, organizations can benefit significantly from using dedicated software or automation tools to manage their overtime costs—tools such as Beebole’s Excel add-in.

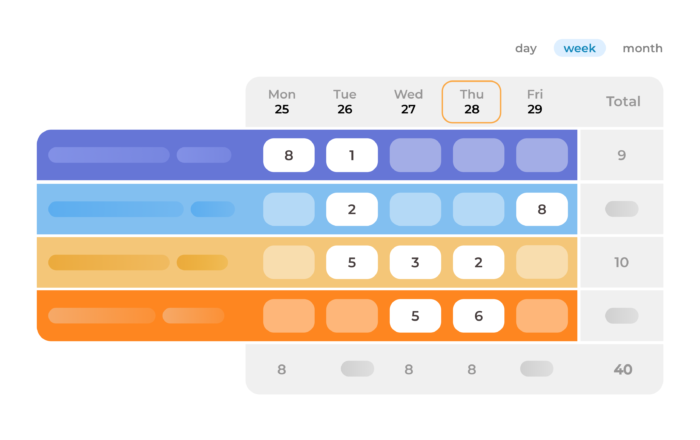

Beebole is a powerful tool for businesses and organizations looking to manage their time and projects efficiently and effectively. With features like project time tracking, time reports, and Google Workspace integration capabilities, it should also be noted that Beebole offers an Excel add-in.

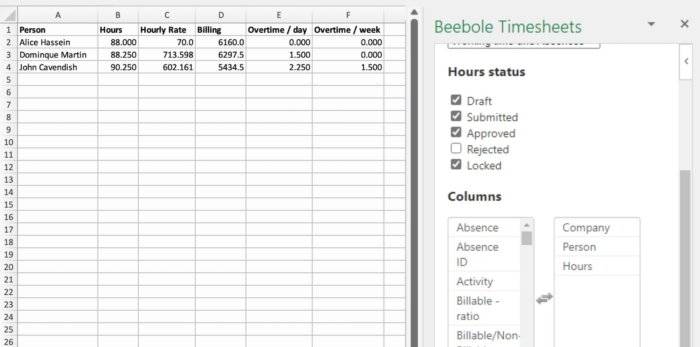

Beebole’s Excel add-in enables users to export data from Beebole’s time tracking and project management system directly into an Excel spreadsheet. All you have to do is press one button, and the add-in automatically imports everything. Gone are the days of time-consumingly doing it all manually.

Once you connect Excel to your Beebole account, you can choose which data to export: time tracking, project, or user data. (Read the full tutorial on how to use the Beebole Timesheet add-in for Excel here!) Choose the desired date range, such as your payroll period, and the hours type and status. Note that Beebole’s detailed reports already offer most of the data required for the overtime calculation described above.

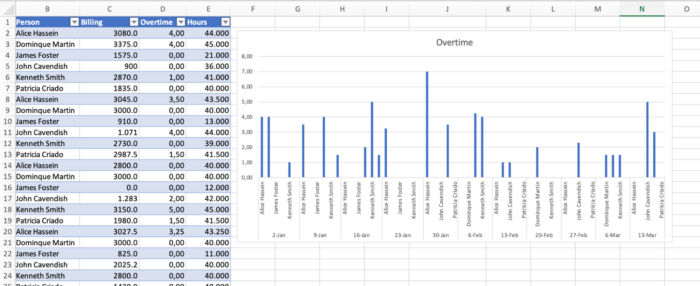

Simply select the columns you’d like to import from Beebole, like regular hourly rate, hours worked, and overtime worked. Beebole’s reports include both daily and weekly overtime calculations.

Once you export the data, it’s all systems go. You can use the exported data in Excel as you would with any other spreadsheet data. In addition, you can perform complex data analysis, create charts and graphs, or combine the data with other data sources to gain new insights.

Beebole’s Excel add-in makes it easier than ever to fetch the necessary information to comprehensively do an overtime cost analysis and confront many of the challenges head-on. There’s a reason why Beebole works with 1000+ customers in 63 countries and why organizations of all sizes and sectors use its product suite to achieve outstanding results.

Managing overtime costs is crucial for businesses to manage their budgets and resources effectively. However, tracking and analyzing time data can be challenging, especially in a rapidly changing business environment. Companies must always identify areas of rising costs, where productivity could improve, and where additional resources could get deployed.

Adequate time tracking software can help companies automate this process, especially concerning overtime cost analysis.

By automating the process of overtime cost analysis, companies can save valuable time and resources and make informed decisions that improve their operations and bottom line.

Time tracking tools to track billable hours have become indispensable assets for operations and finance managers seeking to optimize profitability and maintain precise project cost control. By accurately capturing the time spent on various tasks and projects, these applications provide helpful information for workflow efficiency, resource allocation, and billing accuracy. Also, they eliminate the guesswork and potential errors associated with manual time […]

The challenge of managing projects with multiple billing rates This guide aims to provide insight into the dynamic world of project billing, underscoring the necessity for precision, consistency, and foresight in managing multiple billing rates. As a Beebole implementation consultant, I’ve seen my fair share of scenarios filled with these challenges. So please follow along […]

Are you exploring the intriguing world of python for finance? Whether you aspire to work in the financial industry, or wish to advance your existing career, mastering Python is a key step forward. In today’s fast-paced financial arena, Python programming is a crucial skill that top institutions seek in their professionals. Dive into this article […]