Project cost management: Adjustable forecasting and the Excel OFFSET function

Table of Contents

Table of Contents

Today we’re talking project cost management with adjustable forecasting and the Excel OFFSET function. Follow along below, or watch the tutorial on YouTube by clicking here.

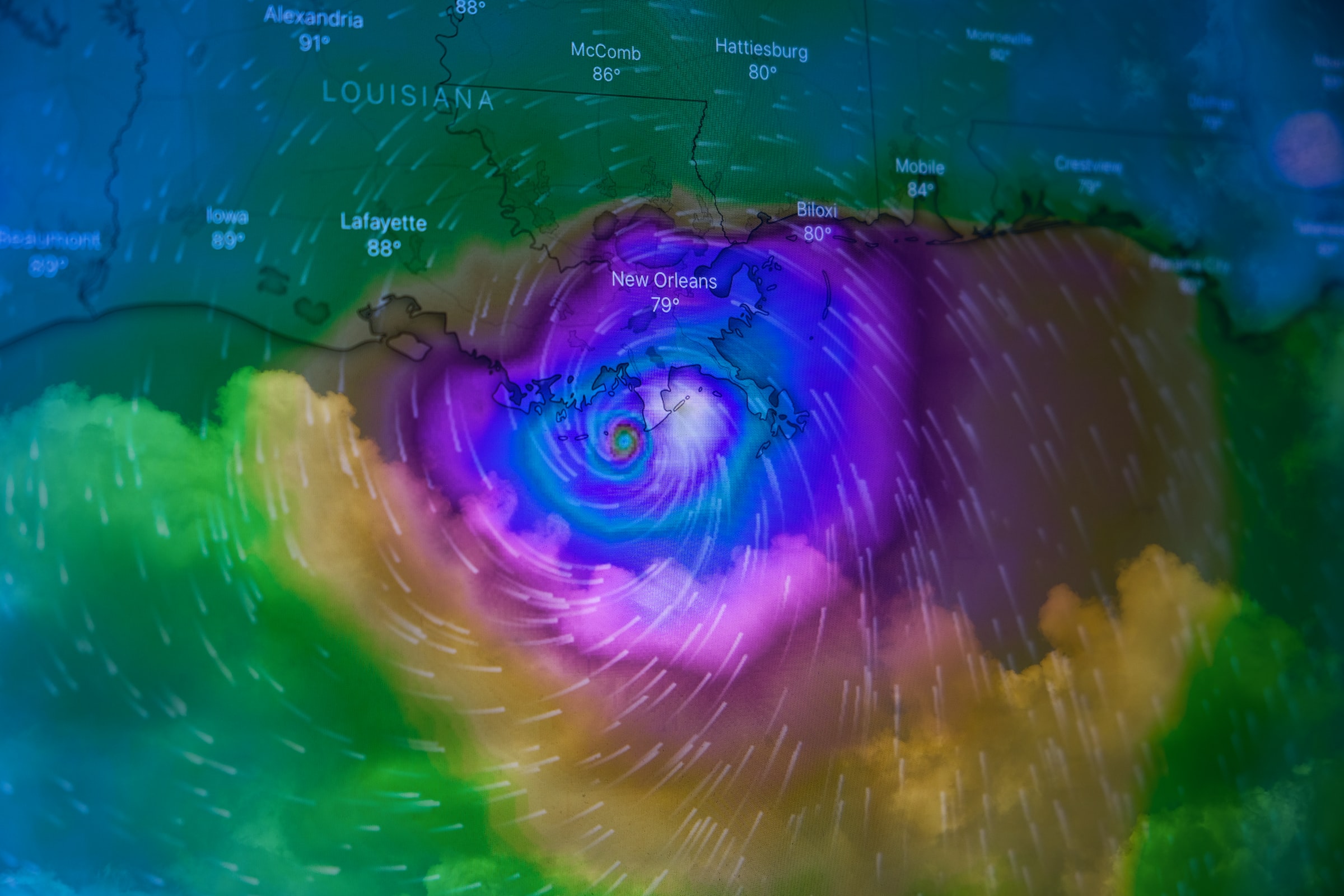

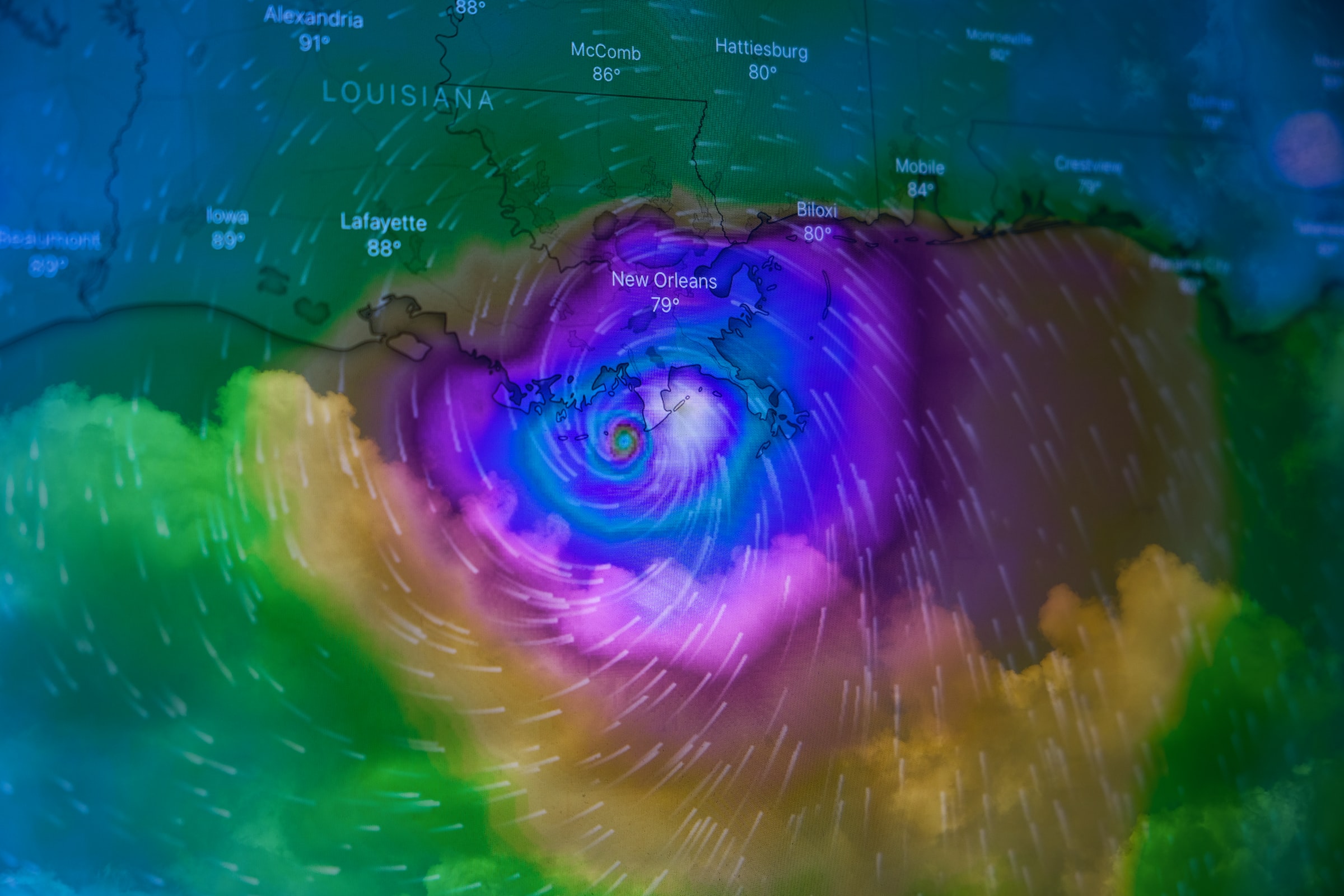

The first time you heard about a forecast, it probably had nothing to do with project cost management. The team of weather experts behind that forecast used a range of data, inputs, and knowledge. This combination created an output you used to plan.

As we all know, weather forecasts are never perfect. But that doesn’t mean they aren’t useful. A directionally correct forecast is far more useful than intuition alone. The same applies to financial forecasting, which guides business teams on major decisions.

A financial forecast helps us to plan for an uncertain world. In project cost management, you have many variables to consider that could alter the project’s success. Calculating the range of outcomes is key to knowing when and how to adjust.

In this tutorial, we’ll work with Microsoft Excel and the OFFSET function to create flexible forecasts. These are absolutely key when it comes to project cost management. Using this approach, it’s easy to build a range of scenarios and predict outcomes. A quick reminder that you can watch this tutorial here.

Before we begin, you can download the Excel template showcasing the Excel OFFSET function here for the best results.

Project cost management is a crucial part of project management that involves estimating, budgeting, and controlling project costs to complete a project within the approved budget while fulfilling its objectives. It starts with cost estimation, determining necessary resources and their costs. This is followed by cost budgeting, which establishes a cost baseline, aggregating all estimated costs. The final stage, cost control, involves tracking project status and managing alterations to the cost baseline, often employing tools like earned value management (EVM).

Effective cost management helps ensure a project delivers value and aligns with strategic goals. It involves understanding the project scope, risks, and schedules, and effective communication to manage stakeholder expectations. Efficient cost management prevents cost overruns, potential project failure, and potential financial loss, contributing to project success. It focuses not on cuts but on strategic resource usage for enhancing project value.

Forecasts are built on scenarios. Those scenarios consider a range of variables that may shift under varying conditions. These scenarios include internal and external factors and how they might change. While you can’t anticipate every scenario, you can build flexibility with multiple inputs. No one could’ve forecasted the global pandemic in 2020. But, forward-thinking planners had already performed “what-if analysis” work to stress test their business. You might not know the source of the impact, but you can test their effect on the business.

Scenario planning helps you build a range of outcomes when it comes to project cost management. And once you create those projections, you’ll think about how to act within them. As a project cost manager, uncertainty is all too familiar. You face countless questions about cost, project timing, and more. Running a sensitivity analysis across scenarios gives you visibility about how to respond.

See how Beebole can streamline the entire process.

If you’ve got a sharp eye on your project cost management, you probably already know what factors influence your project’s success. Maybe your business relies heavily on a specific material that changes in price. Or, your market ebbs and flows with the economic cycle. The scenarios you build will vary based on your situation, so start by taking stock of your key drivers for success.

Here’s an example of three scenarios that you might generate when you build out a financial forecast:

If you’ve ever found yourself wondering, “What if this happened?” on a project, you should build out a scenario to test it. With the Excel OFFSET function, you’ll learn that you can build limitless scenarios and toggle between them easily.

Now that you’re ready to build your forecast, it’s time to jump into Excel. We’ll build a spreadsheet that includes a range of scenarios, and then give you the tools you need to calculate the outcomes.

In the screencast below, you’ll learn how to build and test your forecasts with OFFSET. You can create inputs and then apply calculations to generate a forecast.

*Discover more tutorials and webinars in Beebole’s video collection.*

If you want to see how to build the spreadsheet in a series of steps, read on. I’ll walk you through using Excel to create scenario planning templates.

Let’s walk through creating a flexible project cost management forecast. We’ll build out a range of scenarios and then add OFFSET functionality that allows us to switch between them easily.

To follow along with this tutorial, download the finished OFFSET Forecast spreadsheet. You can use it as a guide to add your scenarios and estimate project costs.

With project cost management in mind, here are recommended variables for my scenarios:

In Excel, it’s best to create a standalone tab that includes each of these scenarios. The table below includes each of the seven factors I’ll use in my forecast.

Important: To make full use of the offset function, make sure to create a row labeled Scenario #. Each scenario has a number so that we can shift between them with ease.

Think of your forecast as a sensitivity analysis: “If a given factor changes by X%, what’s the impact on my earnings?” With these scenarios, we can test exactly that.

Now, it’s time to build a projections tab that connects to our scenario variables. With this set of projections, we’ll see a detailed calculation for our project financials.

Let’s switch to a new tab and lay out our spreadsheet. In my case, I’m going to create a column for each month between 2023 and 2025. Then, each row in the forecast model uses an input variable.

Go ahead and add placeholder rows for each of the row calculations we need. Don’t worry about perfecting these formulas for now; just ensure that there’s a row placeholder for each.

Also, I’m going to use the highlighted section in the cells above as my control panel. This is the area where we can change the scenario number and recalculate everything we need:

There’s another important component to this spreadsheet, and that includes the scenario details. Remember, we built these out on the standalone Inputs tab. But we’ll carry them through to this tab so that we see the scenario details.

Here’s the goal: as we change the scenario number, we pull all of the details of that scenario through to our Projection tab. So, how do we make the calculations dynamic as the scenario number changes? This is the power of the OFFSET formula.

Just below the area we built for projections, let’s add our Scenario details. Don’t retype these details—let’s connect them back to our Scenarios tab. We want to build this dynamically so that as the scenario number changes, so will all of the inputs.

Let’s write our first formula for the Project Starts date, which will use the OFFSET function:

=OFFSET(Inputs!C7,0,Projection!$B$2)This formula follows a few steps, with each step separated by a comma:

Now, every other cell is a matter of simply moving the reference cell from Inputs down by one column. Notice the similarity in the formulas, as they all point to a scenario, shifting only based on the scenario you select.

| Variable | Formula |

| Project starts | =OFFSET(Inputs!C7,0,Projection!$B$2) |

| Build time | =OFFSET(Inputs!C8,0,Projection!$B$2) |

| Total project investment | =OFFSET(Inputs!C9,0,Projection!$B$2) |

| Customers added per month | =OFFSET(Inputs!C10,0,Projection!$B$2) |

| Monthly customer revenue | =OFFSET(Inputs!C11,0,Projection!$B$2) |

| Customers churning out | =OFFSET(Inputs!C12,0,Projection!$B$2) |

| Cost of sales % | =OFFSET(Inputs!C13,0,Projection!$B$2) |

| Customers start | =EDATE(D18,D19) |

The last formula for “Customers start” uses the EDATE function to shift by a specified number of months. It takes the start date and adds the scenario’s “Build time” variable to know when revenue should start.

So far, we’ve got everything “hooked up” in this model. We’ve brought through the scenario details from the Inputs tab. Read on to apply the needed calculations for optimized project cost management right in Excel.

We’ve pulled through our scenario details. Now, it’s time to create our projections. Projections take details from a scenario and then apply calculations to them.

As part of our forecast, we’re going to make all of the calculations that you see below. While every forecast differs, it should include each of your input variables in a calculation.

Let’s walk through the formulas built for each of these rows, plus a short explainer of how it works. The example formulas use column E, but work as you drag them across to each month.

| Cell | Formula | Explanation |

| Investment made | =IF($D$18=E2,$D20,0) | This formula looks at the scenario table and compares the date to the “Project Starts” date. It then inserts the project investment amount. In essence, the formula fills in the investment in the intended start month. |

| Customers added | =IF(E2>=$D$27,$D$21,0) | This formula looks at the scenario table and inserts the number of customers added. But, it only does this if the date is after the project completion date. (After all, we shouldn’t have customers before our project finishes.) |

| Customers churned out | =-IF(E2>=$D$27,$D$23,0) | Similar to the “customers added” input, this includes the number of customers we lose each month. Again, it uses the “Customers start” helper field. |

| Net # of customers | =(E6+E7)+D8 | This formula multiplies customers times the average revenue per customer. |

| Revenue | =E8*$D$22 | This formula multiples customers times the average revenue per customer. |

| Cost of sales | =-$D$24*E10 | This formula multiples the revenue times the cost of sales. Since this is a cost, we multiply it as a negative. |

| Gross profit | =E10+E11 | Gross profit is revenue less costs in this formula. |

| Cash impact | =E13-E5 | This formula is designed to estimate the total cash impact, which includes the investment cost. |

With these formulas, we have a complete projection of how our project performs. Simply change the scenario number in the control panel cell, and every formula is calculated. Because we used the OFFSET function, all formulas will shift accordingly.

Our forecast is complete! We can test out scenarios and study the results.

An important part of creating a forecast is sharing it. A summary of the months into year groupings is a great way to do that. On a new Summary tab, I created sums of the months for each financial metric.

This table gives me a ready-to-share visual. Make sure also to link the scenario name from the Projection tab so that you remember which projection the summary shows.

This simply sums up the months of each year. Save the work of recreating this yourself with our included template.

Now, it’s your turn. It’s time to take a step back and ponder what scenarios your business should test. Then, build out a range of possibilities that test the future. This is a beautiful piece of the puzzle that is project cost management.

Remember: Your forecast doesn’t have to be perfect. It’s only a guidepost that you use to steer your decisions. The flexibility you can build with the OFFSET function shows that predicting the future doesn’t have to be painful or time-consuming.

—

Photos by Brian McGowan and Ross Sneddon on Unsplash

The challenge of managing projects with multiple billing rates This guide aims to provide insight into the dynamic world of project billing, underscoring the necessity for precision, consistency, and foresight in managing multiple billing rates. As a Beebole implementation consultant, I’ve seen my fair share of scenarios filled with these challenges. So please follow along […]

There is a considerable number of project time tracking tools on the market. Because there are so many options, we’ve created this guide to today’s top project time tracking tools, making sure to include tools that offer features and price points to meet the needs of teams and businesses of all sizes. Project time tracking […]

As artificial intelligence grows in popularity, every company is now competing to launch tools that leverage AI inside their existing apps. Microsoft’s launch of Copilot, an AI assistant tied into the Microsoft 365 ecosystem, plants their flag in the world of AI. It’s no surprise that you might be asking yourself: How can I integrate […]