3 examples of Microsoft Copilot for financial planning & analysis

Table of Contents

Table of Contents

As artificial intelligence grows in popularity, every company is now competing to launch tools that leverage AI inside their existing apps. Microsoft’s launch of Copilot, an AI assistant tied into the Microsoft 365 ecosystem, plants their flag in the world of AI.

It’s no surprise that you might be asking yourself: How can I integrate AI in my day-to-day work in financial planning and analysis? And in the world of FP&A, what do new AI technologies like Microsoft Copilot mean for you? This article will explore Microsoft Copilot for financial planning and analysis, and what it can and can’t do for FP&A teams.

For Microsoft, the opportunity with Copilot is clear. Microsoft already owns the business productivity space through its Office 365 suite. Apps like Excel, Word, PowerPoint, Teams, and Outlook rule the roost of the corporate world.

Enter Microsoft Copilot. With a reported 400 million users on the Office 365 platform, adding artificial intelligence to each of these apps means that you’ll get more done with less effort. With access to your datasets across Microsoft Fabric and tight integration with productivity apps, Copilot could become your go-to assistant in the corporate world.

Copilot is now generally available, which means that you (or your IT team) can enable it for your environment. Currently priced at $30 per user per month, Copilot is part of the broader Microsoft 365 ecosystem.

Microsoft Copilot and Dynamics 365 Finance are related through integration and functionality enhancement. Copilot, as an AI-powered tool, is designed to work seamlessly with Dynamics 365 Finance, a part of Microsoft’s suite of business applications. This integration allows users to integrate the capabilities of both platforms in a complementary manner.

Financial Planning and Analysis teams need all the help they can get, and thankfully there are quite a few options when it comes to financial analytics software. Let’s think about how Copilot could help to solve and alleviate some of the pain points that come with the role.

Maybe you’re expecting tools like Copilot to do all of the number crunching and analysis for you. While there are certainly features to help you with calculations and analysis, I’m excited about the potential of AI to help us improve and expand communication.

FP&A teams are at their best when they become embedded in the business. The idea of “business partnering” – becoming valued, trusted advisors for the business objectives – is key to making an impact. This requires frequent communication.

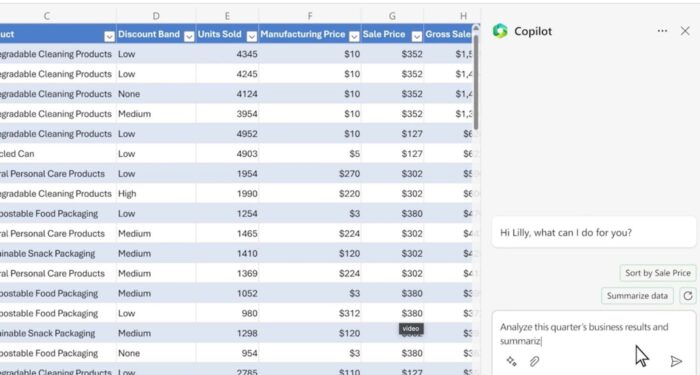

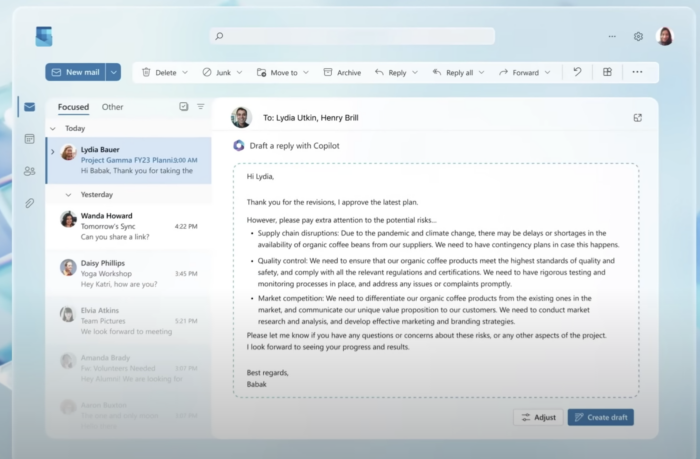

With Copilot for apps like Outlook and Teams, you can kickstart your communications. Microsoft shows examples of using Copilot to rapidly draft emails on Outlook.

These use cases highlight AI’s power to serve as a true assistant in day-to-day tasks. If an email is easy enough to draft and send, you’re more likely to do it. FP&A teams with busy inboxes are sure to benefit from an assist from Copilot.

The best FP&A analysts are curious. They find their mind wandering to those unanswered questions about the business. How should we adjust our pricing? Who are our top customers in each market segment? How is our performance compared to the same time last year for specific products?

The problem is that the demands of FP&A roles are high. That leaves less time to explore those curiosities and find new insights. The monthly churn of routine reporting has a way of taking center stage, stealing all the time needed for those game changing analyses.

The expectations for FP&A teams have rapidly evolved, too. No longer are teams expected to simply crunch numbers and crank out routine reports. There’s an expectation that the business looks to FP&A for deeper insight and analysis. But if you’re busy with manual, repeated work, you might not have time for value-add analysis.

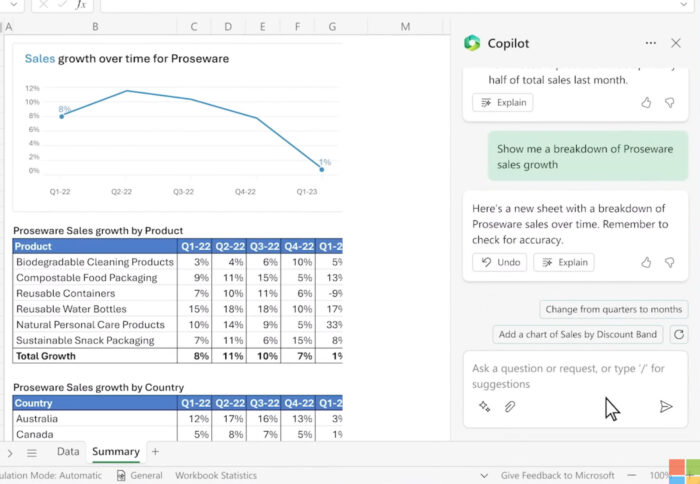

Enter the power of Copilot for financial analysis. By reducing the friction involved with exploring and analyzing data, you’ll generate more insight. Copilot works for both Excel and PowerBI, which many finance teams lean on for day-to-day planning and analysis. Busy CFO’s can leverage these insights as a jumping off point for future analysis, further partnering them with the business.

Think of a tool like this as an extra set of hands. You can feed Copilot ideas for those unexplored parts of the business, then build on the results. Excel serves as the cornerstone for nearly every finance and accounting team, so it only makes sense to leverage Copilot to help you kick off an analysis with less effort.

The first thing we know about every financial forecast is that it isn’t perfect. Still, that doesn’t negate the value of creating forecasts that help to set the course for the business.

The reason why forecasts are painful is because they take time. And they include various inputs that take time to tweak, update, and adjust. But AI offers the promise of automating much of the manual machinations required for scenario building.

In short: if scenarios become easy enough to build, you’ll create far more of them. And that helps you plan for uncertainty.

Microsoft’s coverage of demand planning case studies highlights some of the ways that teams are adopting Copilot for forecasting. Built in conjunction with their Microsoft Dynamics 365 ERP, Domino’s UK is leveraging Copilot for demand and inventory planning. It combines historic data with more powerful factors for granular forecasting.

I believe that one of the biggest opportunities to leverage AI in forecasting is to expand the number of scenarios we build. In a rapidly changing world, you’ll need more ways to slice and dice your outlook. Copilot might just be the assistant you need to reduce cycle time and expand your outlook.

As a former FP&A leader, I often dealt with what I called “shiny object syndrome.” It goes something like this:

Sound familiar? With the AI arms race in full force, many teams feel the heat to implement tools that take advantage of generative technology. Increasingly, AI is a part of every procurement process. Teams are pushed to ensure that the tools and platforms that they choose today leverage AI.

Here’s the problem: AI might feel like magic, but it still requires a firm foundation. In FP&A, that foundation is solid data. Teams struggle with wrangling data from multiple sources and cleaning it up for use. Data follows a “garbage in, garbage out” model – meaning that low quality data can only yield low quality insight, regardless of the AI tools glued on top.

While your organization might purchase and enable tools like Microsoft Copilot, they are not cure-all’s for your team’s challenges. Shiny marketing videos that show AI tools that output deep insight and perfect charts gloss over the most important step: data consolidation and aggregation.

One way that Microsoft is proactively dealing with this is by launching Microsoft Fabric, which it touts as a unified data analytics platform. Fabric seeks to unify data sources across the organization and give more cohesive control over access and permissions. Copilot works directly with data on Dynamics365, or other sources via Microsoft Fabric. That means that other ERP’s will need to connect to Fabric to harness the full power of data.

But teams still need to go through the process of deciding “who has what.” After all – Copilot shouldn’t give flight directions to a passenger instead of a pilot.

I’m a big believer that every company needs a data steering team. These work best as cross functional well-run data strategy teams focus on three things:

If you’re considering adopting Microsoft Copilot as an AI powered assistant in FP&A, I highly recommend starting with a fresh look at the data within your company.

Extended Planning and Analytics (xP&A) in corporate finance refers to the expansion of traditional financial planning and analysis (FP&A) beyond the finance department to encompass all areas of business planning. It integrates financial planning with operational planning, allowing for a more comprehensive and cohesive approach to business strategy and decision-making.

Since xP&A aims to break down silos between departments, enabling cross-functional collaboration and more accurate, real-time insights for better business outcomes, Microsoft Copilot could be also highly beneficial for xP&A:

Microsoft Copilot holds a lot of promise. If your company is tapped into the Microsoft ecosystem, it’s only natural for your FP&A team to try it out. Whether you use it to help you create more communication, faster forecasts, or launch new analyses, Copilot is worth a test flight.

Remember: AI powered tools rely on high quality data to leverage the most insight. Whether a human or a chatbot serves up insight, the quality of your data controls the quality of your analysis. Remember to take a fresh look at what you store and how it’s structured before you unleash any tool.

If you’re remotely interested in project management, then you’ll likely be quite familiar with the scope-budget-time project management triangle. As with many tried-and-true ideas and theories, sometimes it can be good to hit refresh and come at it from a new angle. And that’s what I’d like to do today—let’s have a look at the […]

Are you exploring the intriguing world of python for finance? Whether you aspire to work in the financial industry, or wish to advance your existing career, mastering Python is a key step forward. In today’s fast-paced financial arena, Python programming is a crucial skill that top institutions seek in their professionals. Dive into this article […]

To deliver a product or service within a specified time and budget you have to juggle a variety of activities, responsibilities, and stakeholders. Estimating the project’s cost and keeping tabs on actual spending are two crucial aspects for project managers. Budget to actual variance analysis is the comparison of the budgeted and the actual cost […]