Table of Contents

Table of Contents

In today’s rapidly evolving business landscape, organizations face an increasingly complex challenge: how to maintain accurate forecasting and effective risk management while navigating unprecedented levels of uncertainty. As US Economist Michael Hammer wisely noted, “The secret of success is not to predict the future but to create an organization which can prosper in an unpredictable future.” This insight perfectly captures the essence of Extended Planning & Analysis (xP&A), a transformative approach that’s reshaping how organizations plan and make decisions.

Discussions often swing between vague generalizations and overly technical complexities. This article aims to bridge that gap by breaking down the core components of xP&A implementation to help you better understand what this transformation entails.

What is xP&A in simple terms?

What is xP&A?

xP&A (Extended Planning & Analysis) is a holistic business strategy that extends planning beyond finance to include all departments, creating one connected system where everyone works together using shared data and analytics to make better decisions for the organization as a whole.

According to “Extended Planning and Analysis (xP&A): FP&A’s Role in Business Transformation” written by Larysa Melnychuk, CEO and Founder at FP&A Trends Group and Michael Coveney, Author and FP&A Thought Leader, xP&A represents a complete transformation of both the FP&A function and the organization’s culture, shifting toward a more analytical approach through fact-based and future-oriented insights.

Rather than a rigid process or just a set of tools, xP&A is primarily a business strategy. It’s a vision for how planning and analysis should work across an organization, focusing on breaking down silos between different departments to create a more collaborative and integrated approach to planning.

xP&A recognizes that financial statements are shaped by data and decisions from across the organization. Rather than keeping planning activities isolated within departments, xP&A promotes collaboration across business units to create a more integrated planning approach.

“Instead of viewing financial planning as a standalone task, xP&A integrates data and insights from across departments to create a cohesive, real-time picture of business dynamics,” explains Petr Polanecký, Senior Associate at PwC. The goal is not to take control of other departments’ planning processes, but to foster meaningful collaboration that enriches the overall planning ecosystem.

At its core, xP&A requires coordinated cross-departmental collaboration with centralized oversight. This orchestration is essential because different business units typically operate with varying timelines, formats, and data structures. This need for structured collaboration and top-down mandate is what makes xP&A a business strategy rather than just a process or tool. Its fundamental purpose is to establish executive-driven mandates that break down planning silos and drive decisions benefiting the entire organization rather than individual departments.

xP&A for leveraging forecasting and risk management in project planning

While traditional FP&A may serve you well today, embracing xP&A offers two key competitive advantages: Firstly, it drives efficiency gains through better-aligned decision-making, and secondly, it ensures optimal resource allocation by getting all departments working toward shared organizational goals rather than pursuing siloed objectives.

This holistic approach revolutionizes forecasting and risk management by integrating financial planning with other essential business functions like sales, operations, and purchasing. “For example, connecting financial plans with sales forecasts, demand trends, and supply constraints allows for more precise alignment between projections and operational realities, enabling a proactive approach to risk management,” argues Polanecký.

Enhancing forecast accuracy

xP&A improves forecasting accuracy by incorporating drivers from across the organization. While traditional financial forecasting might focus solely on profitability, xP&A integrates diverse factors like marketing campaigns and operational metrics. This broader perspective leads to more comprehensive and accurate predictions.

Strengthening risk management

xP&A significantly enhances risk management by providing visibility into risks that might be overlooked in siloed planning. For example, it can reveal capacity constraints or supplier limitations that could affect profitability. By evaluating risks from multiple business perspectives rather than just financial angles, organizations can identify and address potential issues before they impact performance.

This integrated approach ensures that planning decisions consider both opportunities and risks across all aspects of the business, not just financial metrics.

“With near real-time data inputs, we can quickly assess the financial impacts of unforeseen events—be it demand fluctuations, supply chain disruptions, or changes in customer behavior—and adjust our strategies accordingly. Some of the most valuable techniques, in my view, are cross-functional scenario planning and business intelligence, which help illustrate the most impactful future scenarios, their implications, and present the data as a clear story so that everyone can easily understand,” states Polanecký.

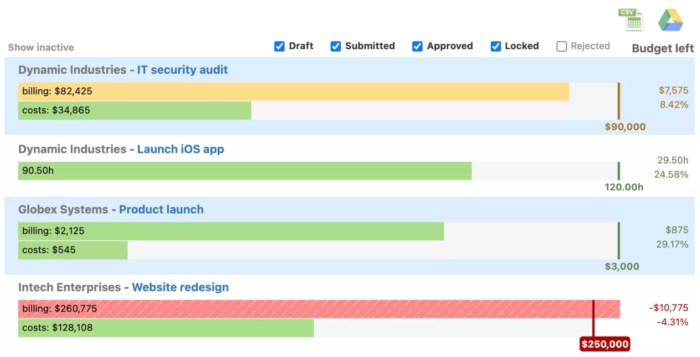

Real-world results show just how powerful better forecasting and visibility can be. Rancho BioSciences manages 100+ simultaneous projects with teams distributed across clients and geographies. Before Beebole, they struggled with limited visibility into budgets and forecasting, making it difficult to anticipate risks or keep leadership informed.

By using Beebole’s open API and effective project time tracking, they now can:

🚀 Compare actual costs against forecasted budgets in real time

🚀 Spot risks early and prevent costly overruns

🚀 Accurately report to upper management with up-to-date insights

🚀 Centralize project and resource data to support smarter forecasting

“It sure beats spreadsheets. I love the snapshot views it gives me. I can log in and easily see the status of 130–140 active projects. If I want to dig deep, all the data is there.”

How to prepare your organization for extended planning & analysis (xP&A)

As we mentioned before, xP&A is a holistic business strategy that implies a big transformation at the organizational level. As cited in “Extended Planning and Analysis (xP&A): FP&A’s Role in Business Transformation”, “xP&A is not just an FP&A initiative. It requires a complete shift on how an organization plans and manages resources, with FP&A overseeing the different planning activities, lending support, and challenging conclusions.”

Furthermore, while discussions about xP&A often focus on supporting technology, the truth is that software alone can’t deliver results without implementing the necessary organizational changes that are needed for this integrated, cross-functional approach to planning.

“Only after aligning people and processes should technology come into play. Technology can standardize and automate, but it only works if it’s tailored to meet the organization’s unique needs. I’ve seen companies assume technology alone will resolve their challenges, but without a strong foundation in people, processes, and alignment, the benefits of xP&A are limited. It’s all about ensuring that the technology supports the organization, not the other way around,” argues Polanecký.

Key steps for moving to xP&A

Early xP&A adopters recommend the following when implementing this strategic planning approach:

- Create an xP&A vision document

- Map out the planning process and content

- Move to intelligent driver-based models

- Embrace scenario planning

- Evaluate and implement suitable technology

- Upskill FP&A

- Look for opportunities to start the change

The first two action points are fundamental for implementing the organizational changes needed to embrace xP&A effectively. As Polanecký explains, “implementing xP&A starts with a clear vision and strategy that outlines the competitive advantage the organization aims to achieve. Once that’s in place, the next step is to revisit and potentially redesign the operating model, transforming processes to support an integrated, cross-functional approach.”

In other words, success hinges on effectively aligning your people and processes. But how? Polanecký suggests “to assess where we are by leveraging benchmarking, based on results, define the areas of focus, and then go from the strategy level down to an operational level to define the target process with all the stakeholders.”

It’s important to note that while xP&A begins as a business strategy, its successful implementation follows a phased process. Organizations often start by integrating two complementary functions—commonly pairing either sales with marketing or finance with supply chain planning. However, maintaining this integration requires ongoing effort and governance, as departments naturally gravitate back to siloed operations without proper oversight. This is a continuous journey rather than a one-time transformation.

The importance of a solid top down mandate

Implementing xP&A requires a clear top-down mandate to succeed. While individual departments are often efficient in their specialized roles, cross-departmental collaboration demands some trade-offs in efficiency to gain broader organizational benefits. This transition can’t be driven from the bottom up—an individual department can’t initiate xP&A without executive support. This top-down mandate must include:

- Clear executive sponsorship

- Authority to drive cross-departmental collaboration

- Dedicated budget for implementation

- Designated leadership with authority to coordinate across divisions

Simply having a mandate isn’t enough. It needs to be backed by resources and real authority to overcome departmental boundaries. While there’s typically no dedicated xP&A lead position, someone with sufficient organizational influence must champion the initiative with full executive support.

To successfully implement xP&A, you need a structured approach built around the following actions:

- Start by understanding your business processes and key drivers

- Map out how different departments need to interact and share information

- Adapt data models to enable these interactions

- Agree on shared terminology across departments

- Only then select and implement appropriate platforms/tools

The key is focusing on process and data alignment before jumping to technical solutions. This ensures the implementation addresses actual business needs rather than just adding new tools.

Choosing the right xP&A software for your business

The implementation of xP&A requires careful consideration of tools and platforms that can support integrated planning across the organization. While the specific technology stack depends on each company’s existing infrastructure and needs, several key components are essential for successful xP&A implementation.

1. xP&A planning platforms for finance teams efficiency

The foundation of xP&A implementation lies in flexible planning platforms. Companies have two main options, which can be better understood through practical examples:

Single platform

A mid-sized manufacturing company using SAP Analytics Cloud as their sole platform for financial planning and forecasting, sales planning, supply chain planning, workforce, and production planning.

Multiple platform

A large retail corporation using an integrated suite of specialized tools such as Anaplan (financial planning and analysis), Salesforce (sales planning and customer analytics), SAP Integrated Business Planning (supply chain), Workday (workforce planning and HR analytics), and Microsoft Power BI (data visualization and reporting).

The key difference is that in the single platform approach, all planning functions run through one system, while the multiple platform approach uses best-of-breed solutions for each function, integrated through a common data architecture.

For most large organizations, a single platform often can’t meet all specialized planning needs effectively, which is why they opt for multiple integrated platforms. However, this requires robust data integration and governance to ensure consistency across systems.

According to Polanecký, having a single platform for xP&A is challenging because each department—finance, sales, operations—has unique requirements and views on data. Different functional needs require distinct logic, data levels, and views, so a single system often can’t fully support all areas effectively. However, what he finds to be a strong approach is consolidating these systems under a single, familiar user interface. This allows people to interact with the same front-end while the background is powered by several specialized tools. It’s a logical step forward that enhances user experience and cohesion without compromising functionality.

“Whether a single or multiple systems are used really depends on the organization’s complexity and process maturity. For smaller or less complex companies, one system could be sufficient, but for larger, more complex organizations, a combination of tools is usually necessary to meet diverse needs,” argues Polanecký.

2. Data architecture for better analysis

Beyond planning platforms, organizations need:

- Strong data architecture to support transformations

- Systems for managing data handovers between platforms

- Capabilities for maintaining data consistency across systems

3. Market leaders for xP&A

The xP&A platform market includes two main categories:

ERP-centric vendors

- Key players: SAP, Oracle, Workday

- Main advantage: Native integration with operational plans

- Best for: Organizations heavily invested in these vendors’ ecosystems

Independent vendors

- Key players: Anaplan, OneStream, Jedox

- Focus: Specialized planning and analysis capabilities

- Best for: Organizations seeking best-of-breed solutions

Each vendor category offers distinct benefits, and the choice often depends on the organization’s existing technology infrastructure and specific requirements.

4. Supporting tools for financial forecasting

Project and time tracking tools

While not core to xP&A functionality, project tracking tools play a valuable role in:

- Breaking down implementation into manageable blocks

- Monitoring progress toward xP&A goals

- Managing the gradual rollout of xP&A capabilities

- Coordinating cross-functional implementation efforts

- Improving overall forecasting accuracy and risk management

- Understanding resource utilization, the time it takes to complete tasks, and project progress and completion

- Pinpointing schedule delays and cost overruns as early as possible

According to Polanecký, time and project tracking tools are valuable for planning and monitoring implementation progress. “They add structure and visibility, but I’ve also seen successful projects managed effectively with simpler tools, like Excel. Ultimately, the choice depends on the project scope and team preferences, though having dedicated tracking tools certainly brings added clarity and efficiency to large, complex implementations,” affirms Polanecký.

can better predict future resource needs and budget requirements.

5. Integration considerations

Successful extended planning and analysis (xP&A) implementation requires thoughtful evaluation of the technology ecosystem supporting it. Before investing in new tools or platforms, organizations must examine several critical factors that will impact both short-term adoption and long-term success. These considerations ensure your xP&A solution works harmoniously with existing infrastructure while providing a foundation for future growth.

When selecting tools, organizations should consider:

- Compatibility with existing ERP systems

- Data warehousing technology requirements

- Integration capabilities between platforms

- Scalability needs as xP&A adoption grows

- Interoperability with operations systems and tools, such as an appointment scheduling tool, data analysis tools, project management tools, and more

The key to successful tool selection lies not in choosing the most advanced platform, but in ensuring that the selected tools can effectively support the organization’s specific xP&A requirements while integrating seamlessly with existing systems and processes.

Example: Beebole’s Excel add-in demonstrates seamless integration for xP&A implementation. By connecting employee time tracking data to spreadsheets, teams can import actual resource data for accurate forecasting without disrupting workflows—bridging daily operations and strategic financial planning.

6. Cost-related considerations

If you are wondering about the costs of this technology, let’s examine some estimates from planning and analytics experts. For a mid-sized organization with around 50 concurrent planners, initial xP&A platform costs typically range from €30,000 to €80,000. Implementation services often require a similar investment, ranging from €50,000 to €150,000, depending on organizational complexity and data requirements. These figures tell us two important things about xP&A implementation:

- First, these substantial investments reflect xP&A’s target market: complex organizations with sophisticated planning needs. The price tag is justified because these platforms solve specific challenges that large organizations face, such as managing complex data structures, processing intricate data flows across departments, and supporting hundreds of users working simultaneously on interconnected but distinct plans.

- Second, these costs underscore why implementing xP&A with basic tools like Excel isn’t feasible. While Excel is a powerful tool for many business purposes, it simply cannot provide what xP&A requires: a single source of truth with integrated data across departments, advanced scenario planning capabilities, and reliable data maintenance at scale. The complexity of true xP&A implementation demands specialized platforms designed for enterprise-wide planning and analysis.

For companies with limited budgets, Polanecký recommends focusing on a solution that meets core strategic needs and perhaps considering niche or lower-cost platforms. “You don’t necessarily need a high-end system; instead, look for a cost-effective option that fits your business case and long-term goals. For example if I am fine with the basic functionalities and my process is not that complex I could use some platform such as Bord or Jedox for financial and supply chain planning and analytics instead of top tier solutions such as SAP Analytics cloud and SAP IBP,” explains Polanecký.

Turn Your Team's Time Data into Powerful Forecasting Insights

Key skills for implementing xP&A

Successful implementation of xP&A requires two key skill sets:

Mindset & business understanding

- Collaborative approach and willingness to work across departments

- Deep understanding of business processes and operations

- Ability to integrate with different business units

- Openness to crossing traditional organizational boundaries

Technical capabilities

- Understanding of xP&A platforms and tools

- Data analysis skills

- Ability to work with technical teams

- Platform-specific training (available through vendor materials and on-the-job learning)

While technical skills can be taught, the collaborative mindset and business understanding are more fundamental requirements. Success in xP&A depends more on the ability to work across organizational silos than on specific technical expertise.

As stated by Polanecký, “the basis is to get the technical training in the used tools so you know “where to click”, however, the cross-functional business knowledge should be a necessity as well so the staff can assess the implications of their actions for example: If I as a planner will decide to prioritize specific customers orders I should know that this can have implication in the production costs and finance might not like it.”

The future of xP&A

While xP&A may evolve in name and form, its core principle—the need for cross-functional, integrated planning—will remain crucial for business success. What’s truly transformative today is that modern technology finally enables us to deliver on this long-standing vision, even for the most complex organizations. The convergence of advanced data platforms, sophisticated architectures, and AI capabilities is making true integrated planning possible at scale.

This isn’t just an evolution of existing practices; it’s the realization of a decades-old aspiration that was previously unattainable for large, complex enterprises. As organizations continue to grow in complexity, xP&A will become increasingly vital for maintaining competitive advantage and operational efficiency.