Payroll variance explained: A comprehensive guide for finance and HR managers

Table of Contents

Table of Contents

Payroll variance is a running total of how much money your company has paid out to employees for things like overtime, vacation, sick days, and pay raises. It helps finance and HR managers figure out if budgets are being met and if everyone is getting paid the right amount.

Payroll variance reports can be a way to keep track of all the money distributed to employees to ensure they are being treated fairly.

It can also be used on project reports. For salaried employees, you can use a standard cost rate; for actual costs, you can use payroll variance calculations or effective cost rates to report to your general ledger.

Salaried workers are impacted by payroll variance because hourly workers are compensated according to the number of hours they put in. No matter how many hours they work, salaried employees always get paid the same amount. However, rounding problems, like those with outsourced payroll, can cause hourly workers to have payroll variances. Typically, this kind of variance costs less than $1.00.

You must manage payroll variance if you want accurate cost information for jobs.

Payroll variance is crucial to comprehend and control business data because it offers the following benefits:

Calculating payroll variance involves comparing the effective payroll costs to their standard costs. To be more specific, you can figure out a payroll variance by taking the difference between the expected and actual payroll expenses.

Actual Payroll Cost – Expected Payroll Cost = Payroll Variance

For instance, an employee may work more overtime than anticipated. The expected (standard) payroll cost for this employee was $10,000, but the actual (effective) payroll cost ended up being $11,000. You would calculate their payroll variance as follows:

11, 000 – 10, 000 = 1, 000

Many states have gone above and beyond the federal minimum wage to raise wages for their workers in response to the growing disparity between high- and low-wage earners. This has led to a wave of minimum wage increases across the country, giving millions of workers a much-needed income boost and making it easier for them to get by.

The new higher minimum wages are a big step forward in the fight against poverty and inequality. Still, they also bring some problems as businesses adjust to paying their staff more.

For this example, let’s say your business has employees who work at a $13.00/hour rate. Labor laws in your state have made the minimum wage now $15.00/hour. Those changes go into effect this week, so their expected pay will be affected.

$15.00/hour – $13.00/hour = $2.00/hour payroll variance

Because of the change in labor laws, these employees have experienced a $2.00/hour payroll variance. Their salary has permanently increased, and their expected payroll can be increased in the future to accommodate this.

An employee’s unexpected departure can significantly impact how much overtime their coworkers are expected to work. With one fewer person on the team, more tasks may be left undone, increasing the workload and making it more stressful.

This may put additional strain on those who remain in the workforce, requiring them to work longer hours to complete all tasks. Also, it can be hard to find a good replacement as quickly as is needed, so other employees may have to fill the role until a good one is found temporarily. This could result in them having to work overtime.

In this example, a team in your company has suddenly experienced a critical coworker quitting. As your management team scrambles to find a suitable replacement, each team member works about 5 hours of overtime per week. Each team member gets paid $25.00/hour, and your company offers double-time pay for overtime hours.

Before their coworker quit, each team member made $1000.00/week, but now they are making $1250.00/week. Their pay has been affected unpredictably.

$1250.00/week – $1000.00/week = $250.00/week payroll variance

As a result of their coworker leaving the company, each of these team members’ salaries has undergone a payroll variance of $250.00/week. Since this is only a short-term change, the expected pay for these workers shouldn’t be adjusted permanently.

Because of the different eligibility criteria for different types of benefit packages, when an employee marries, their associated benefits at a company may begin to cost more. Most employee benefits, like health insurance, contributions to retirement savings plans, and other options, are tied to the household income level rather than the individual income level.

When two incomes are combined after marriage, the combined wages may move the employee’s total household income into a different, possibly higher, bracket, leading to higher employee benefit costs.

For this example, one of your employees has gotten married and now has a higher income bracket. Per company policy, this employee will now have to pay a higher premium for their benefits. This premium is automatically deducted from their paycheck. Before their marriage, this employee took home $3,800.00 biweekly, but now they will be making $3,650.00.

The payroll variance formula can be used to determine how their pay has been affected.

$3,650.00 biweekly – $3,800.00 biweekly = -$150.00 biweekly payroll variance

$3,650.00 biweekly – $3,800.00 biweekly = -$150.00 biweekly payroll variance

Because this employee is in a higher income bracket, their biweekly pay has experienced a -$150.00 biweekly payroll variance. This change will most likely be in place for the long term, so their expected payroll should be updated accordingly.

You can report payroll variance in a variety of ways. The most common method is to create a spreadsheet that includes employee wages and total hours worked. Once this information has been compiled, you can easily identify discrepancies between expected and actual wages. Additionally, the variance report can audit payroll data for accuracy and calculate penalties or other charges when necessary. Management teams can use the data from these reports to take further action.

Payroll differences should be reported regularly to ensure that the effective costs of payroll are the same as what is standard. To report a payroll variance, you need to include the difference between actual and expected costs.

Payroll variances are reported to various individuals, including financial managers, business owners, and human resources departments. Tracking payroll variances over time is essential to find problems before they get too expensive.

When an employee’s timesheet shows a different amount of time worked than expected, this is a form of payroll variance. This can be due to employees forgetting to clock in or out, taking longer breaks than allowed, or working overtime without recording it on their timesheets. Employee hours can also be affected by things outside the company, such as economic conditions or changes in labor laws or rules.

You can get a variance report from payroll by creating a spreadsheet with all employee earnings and total hours worked. If you are using an automated payroll system, the system should have a built-in report feature that allows you to generate the report. You can also figure out the difference for each employee by hand by subtracting their actual earnings from what they were expected to make. This method is often used to make sure payroll calculations are correct when doing an audit.

The difference between the expected and actual costs should be listed in the payroll variance report, along with an explanation of why there is a difference. The report should also list any changes that have happened over time so that problems can be found before they get too expensive to fix.

Also, it helps to give any information about relevant trends and activities that could help explain the difference. For example, if a company has had more employees than usual, there may be more payroll costs associated with their employment, which could help explain a higher variance amount.

Payroll variance reporting is the process of keeping track of and writing down the differences between what was expected and what was actually spent on payroll. This helps find potential problems. This process is critical because it lets management know about possible problems before they become too expensive.

Payroll variance reports are used by a wide range of people, including financial managers, business owners, and human resource departments.

Financial managers use the data found on payroll variance reports to monitor how well a company’s payroll system works and find any problems that need to be fixed.

Business owners use this information from payroll variance reports to judge how well a company plans its budget and utilizes its resources.

The human resources department uses payroll variance reports to ensure that employees are paid fairly for their work.

By keeping track of how payroll costs change over time, companies can figure out what might need to be changed or improved to ensure their payroll costs are correct. Management teams can then use the analyzed data from payroll variance reports to make well-informed changes or adjustments. Changes such as increasing staff, offering salaries to hourly employees, or changing employee benefits can help management run the business more cost-effectively.

Before you can figure out a payroll difference, you must first figure out why the difference happened. It could be because of wrong employee pay rates, mistakes in keeping track of time, overtime pay, or other things. Once you know what happened, you can look at the payroll data to determine how much of the difference can be attributed to each factor.

Payroll variance reports help employers understand labor costs and plan for future expenses. Furthermore, these reports can highlight areas where the company may need to take action to address any discrepancies or inefficiencies in its payroll systems.

Payroll variance is reported as the difference between expected and actual wages.

The variance can be depicted as a number:

For example, an employee is expected to earn $15/hour, but their actual wages come out to be $14.50/hour. This is how it would be depicted in the payroll variance equation.

$14.50/hour – $15.00/hour = -$0.50/hour (The payroll variance would be reported as -$0.50/hour.)

Actual Payroll Cost – Expected Payroll Cost = Payroll Variance

The variance can also be depicted as a percentage:

Use the variance from the last example to find the payroll variance as a percentage.

-$0.50/hour ÷ $15.00/hour = 100(0.0333) = -3.33% (It would be reported as -3.33%)

Payroll Variance ÷ Expected Payroll Cost = 100(Payroll Variance in %)

For payroll variance, indirect labor is less important because it doesn’t involve things like making or selling. Indirect labor, on the other hand, is done by people who take care of the building, help with office work, and do other tasks that don’t directly help make goods or services. Reducing indirect labor helps companies control costs and only pay employees for revenue-related activities.

Several internal and external factors can affect the difference in payroll at a company.

On the employee level, things like changes in wage rates, unplanned absences, overtime pay, using paid vacation or sick time, and hazard or incentive pay can all cause payroll variances. Additionally, management can impact payroll variance through miscalculations, employee turnover, giving out bonuses, and changing expenses for employee benefits. Lastly, payroll variance can be caused by things outside of the company, such as inflation or changes in labor laws.

A salary variance report and a payroll variance report are different in the following ways:

Salary variance report:

Payroll variance report:

In summary, the key difference lies in the scope and level of detail. A salary variance report concentrates on individual salary discrepancies, while a payroll variance report provides a more comprehensive view of all payroll-related expenses.

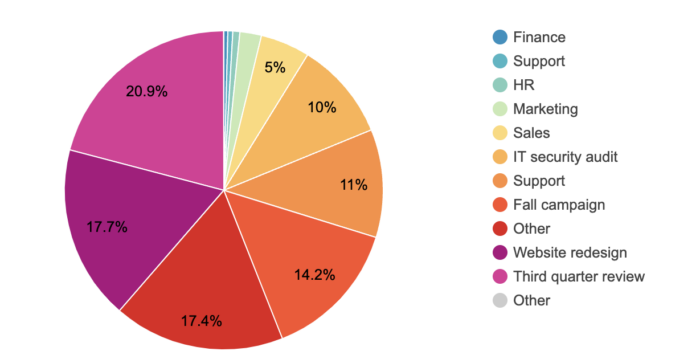

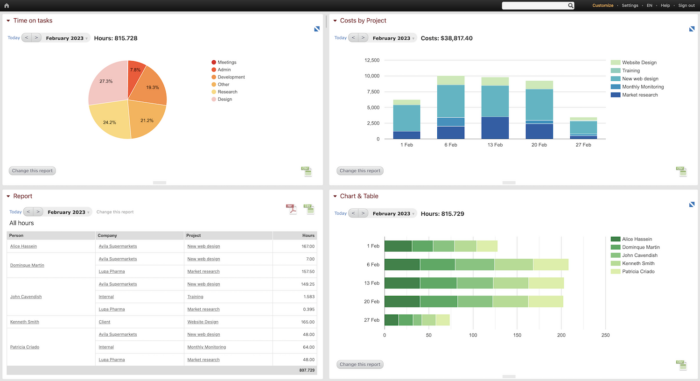

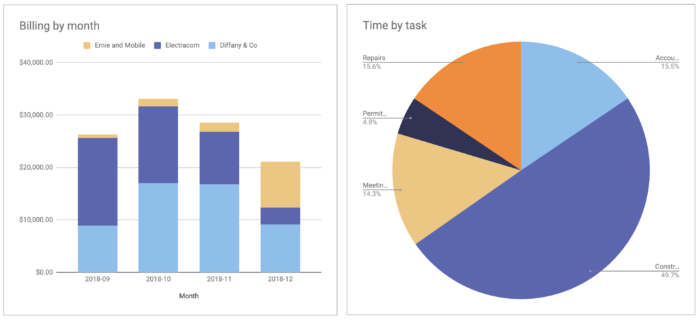

With a tool like Beebole, you can create an unlimited number of reports on the hours worked by employees, their tasks, clients, projects, overtime, and more. You can also make KPI dashboards and distribute reports to particular individuals or groups.

Centralizing information allows you to easily access the information you require without searching multiple systems. This saves you time and money by allowing you to manage your projects and the team better while spending less time on administration and payroll. It lets you focus on other essential tasks while streamlining your company’s operations. Furthermore, because Beebole provides a single secure platform for your business, having all your information in one place reduces the risk of data loss or theft.

You can easily share branded timesheet reports with clients and coworkers by exporting them to a CSV file, a PDF file, or Google Drive with Beebole. Your company can create automated, easily digestible summaries of team performance, logged hours, and any other data it keeps track of using the Microsoft Excel add-in or the Google Sheets add-on.

Your company can keep its old software, making it easier for you and your team to switch. Thanks to its API, almost any ERP or payroll tool can be integrated with Beebole.

In Beebole, reports, or chart and table modules, are used for reporting. Both modules can be reached from your home screen or any business, project, subproject, absence, or task page. Even though these features are limited to Beebole’s desktop version, Beebole is available in many different forms on various devices.

Personalize your Beebole experience by dragging and dropping modules to any location on the screen after clicking the “Customize” button in the top right corner. You can combine as many of these modules as you want to create a one-of-a-kind KPI dashboard that displays your most frequently used reports. Any changes you make to a report are saved automatically. It will stay on your dashboard and automatically get data updates until you delete or change it.

Beebole will completely transform the way you examine your timesheet reports. Beebole keeps track of how much time your employees spend working and makes detailed and dynamic timesheet reports. This means you can spend less time on administrative and payroll tasks.

These reports can be easily exported in a CSV, PDF, or Google Drive format and sent to any team member. Integrating third-party applications like Google Sheets and Microsoft Excel is another great option that Beebole offers you and your team.

Beebole provides various billing options to accommodate any situation your company may face. Beebole can set up payment per person, subproject, job, and hour. There are also fixed-fee and non-billable-hour options.

Beebole’s all-in-one project time tracking software can track your team’s time, breaks, billable hours, as well as time spent on clients, projects, and tasks. Apart from the fact that it can be completely molded to your team and its needs, you can also count on live support in English, French, and Spanish during both North American and European business hours. If you’re looking for a tool that’s easy to use, flexible, and customizable, look no further.

The importance of knowing whether budgets are being met and if everyone is being paid the right amount is irrefutable. A well-done payroll variance report provides key insight into current job cost conformation, and allows leaders to make informed, smart decisions. That’s exactly why payroll variance reporting simply can’t be skipped or done poorly. Whether you’re looking to improve your project reporting or simply your general payroll process and reporting, we hope this article has pointed you in the right direction.

Let us know what your biggest struggle is when it comes to payroll variance reporting in the comments below. We’d love to hear from you.

—

Photo by StellrWeb on Unsplash

For Noelia Podadera, Chief Financial Officer at Packlink, big data and automation for finance are keys to competing in the high-growth delivery industry. She shares these and other insights in this instalment of The CFO Journal, a series featuring financial leaders from around the world. Who is Noelia Podadera? Where: Packlink is an online shipping […]

Absenteeism KPIs are a crucial piece of executive HR dashboards because they shed light on trends and potential issues. Employees miss work from time to time due to different reasons, including being sick or even unplanned absences, and that’s how it should be. It’s unrealistic to expect them to report to work every day of […]

If you’re remotely interested in project management, then you’ll likely be quite familiar with the scope-budget-time project management triangle. As with many tried-and-true ideas and theories, sometimes it can be good to hit refresh and come at it from a new angle. And that’s what I’d like to do today—let’s have a look at the […]