Table of Contents

Table of Contents

So, what does it mean to choose a DCAA compliant time tracking tool? The most simple answer is that for an organization to remain compliant, its timekeeping processes and software must also follow a certain set of guidelines. We’ll get into those details below.

Being DCAA compliant means fulfilling a considerable list of requirements, most of which have to do with accounting, billing, record keeping, and other finance regulations when working contractually with the U.S. government. DCAA compliance is an investment in both your company’s future and livelihood. To put it simply: In order to win (and also maintain!) government contracts, you must be DCAA compliant. The majority of DoD and other federal government contracts explicitly require DCAA compliance, so if you’re not compliant, you simply won’t be eligible to bid on certain contracts. To be DCAA compliant, the tools you choose to use must also be compliant.

What’s the Defense Contract Audit Agency DCAA ?

The Defense Contract Audit Agency (exactly where the DCAA acronym comes from!) was put in place to ensure that government contracts are being carried out as planned and that contractors are complying with the related financial and accounting requirements. In other words, the DCAA’s purpose is to ensure that the U.S. government is getting a fair deal on contracts with private companies. By auditing and overseeing government contracts, the DCAA can ensure taxpayer dollars are being handled properly and that money spent by the Department of Defense (DoD) and other federal entities is being used correctly.

The DCAA was formed in 1965 to streamline and consolidate these financial audits. Before this, each military branch was responsible for its own audits. This translated to very little administration and auditing consistency.

How do CAS and FAR fit into the DCAA?

Before we get any further, let’s talk about CAS (Cost Accounting Standards) and FAR (Federal Acquisition Regulation). You can think of both of these as the standardized guidelines used by the DCAA that contractors must follow when working with the U.S. government. This framework covers all things accounting, billing, and general finance management. CAS details how government contractors should account for and allocate costs, while FAR’s framework outlines the types of costs that are allowed, as well as aspects of the contracting process like acquisition planning, contract administration, and contract cost principles.

A DCAA compliant time tracking tool is the best option for tracking time and costs and providing an easy-to-follow audit trail to the DCAA. The DCAA will use those records during its financial audits where it will also make sure that contractors are compliant with both CAS and FAR.

Why not every company needs to be DCAA compliant

The first thing to understand is that not every company needs to be DCAA-compliant. Rather, DCAA compliance is required only by companies that have (or hope to have) contracts or subcontracts with the U.S. DoD or other federal government agencies.

Companies that need to be DCAA-compliant:

- Government contractors: Companies that provide goods or services to the U.S. government (and especially to the DoD) if said contracts require compliance with the Federal Acquisition Regulation (FAR) and cost principles. Examples include defense contractors, professional services (i.e., consultants, engineering services, IT service providers, etc.) firms, research and development companies, and construction firms.

- Subcontractors to government contractors: Companies that are working as subcontractors to the primary contractor might need to be DCAA compliant, too. This depends on the terms of their subcontract.

- Companies that require payment for allowable costs from the government: This would include companies that have any contract type that requires the government to pay for allowable costs, such as cost reimbursement for time-and-materials contracts. These companies need to comply with DCAA’s accounting and cost-reporting rules.

Companies that don’t require DCAA compliance

- Companies without government contracts: Businesses that don’t provide goods or services to the government and that don’t use government contracting do not need to be DCAA compliant.

- State and local government contractors: Companies working with contracts at the state and local government level don’t need to be DCAA compliant, though they might need to comply with other types of local audit standards.

- Subcontractors in the private sector: Companies that act as subcontractors to companies in the private sector (and therefore aren’t involved in government contracts) don’t need to be DCAA compliant.

Understanding DCAA requirements

There are several different types of contracts that the DCAA audits. They include cost-reimbursement, fixed-price, time and materials, indefinite delivery, and subcontracts. While each contract’s requirements vary slightly, these are the main requirements for companies that want to be compliant with the DCAA.

- Adequate accounting system: The accounting system needs to be able to track direct and indirect costs. It’s also important that costs can be tracked by project, contract, or task, and sorted by category (e.g., labor, materials, overhead, etc.). Last but not least, it’s important to be able to track job-specific costs. This allows for detailed reporting on how funds are truly spent.

- CAS & FAR adherence: Remember CAS and FAR, which we mentioned above? If applicable to your case, you need to follow the CAS guidelines for cost allocation, measurement, and assignment. According to FAR compliance, you need to ensure that all costs are allowable, reasonable, and allocable.

- Billing system: To be DCAA compliant, contractors need to have a functional billing system that provides invoices to the government and reflects allowable costs. For cost-reimbursement contracts, keep in mind that an Incurred Cost Proposal (ICP) must be submitted annually. This is critical for DCAA audits because it details the actual costs incurred against the billed amounts and is used to reconcile costs billed to the government.

- Indirect rate calculations: Contractors must calculate and allocate indirect costs like overhead, general, and administrative expenses to contracts. These indirect rates must be calculated following FAR and CAS standards, and contractors need to be able to support how they allocate indirect costs to government contracts.

- Record keeping: Contractors have to keep accurate and detailed documentation of all financial transactions, including invoices, receipts, labor reports, cost reports, and indirect cost allocations. Contractors are also in charge of keeping and providing supporting documentation for all costs billed to the government, including direct labor, material costs, overhead, and any other expenses related to the contract. These records should be kept for a minimum of three years after the contract is completed in the case of an audit or legal review.

- Internal control checks: Contractors must have internal controls over their financial systems, procurement, and timekeeping in order to prevent fraud and abuse. For contractors using subcontractors, they must make sure that their subcontractors also comply with DCAA requirements.

- Contract compliance: Contractors must follow the specific terms and conditions of their specific government contract, including any unique clauses, reporting requirements, and deadlines. Contractors must also be prepared for DCAA audits at various stages of the contract lifecycle, including pre-award, during, and post-award.

Regulation for DCAA compliant timekeeping systems

Accurate and regulated timekeeping is a key part of DCAA compliance. Because labor costs are a significant part of governmental contracts, DCAA audits focus heavily on timekeeping systems. For this reason alone, a DCAA compliant time tracking system is a must.

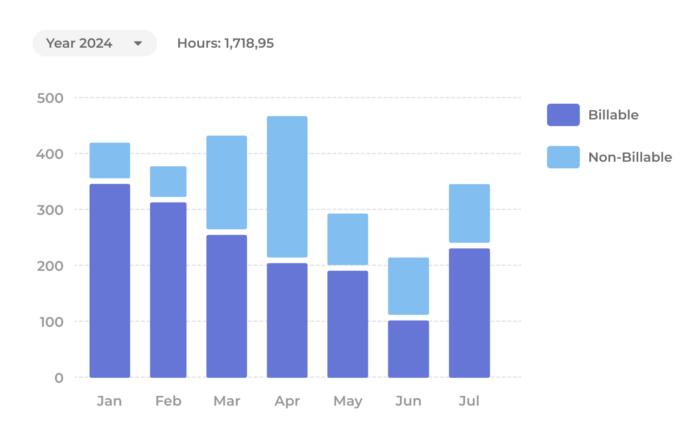

- Labor and timekeeping: It’s crucial that time keeping records are accurate and reliable, and of course, that they’re easy to access and audit. That’s why an accurate timekeeping system to track employees’ time is a must. Employees should record their work time daily, and there should be a clear distinction between billable and non-billable hours. It’s also necessary to have controls in place to make sure that hours can’t be made up or modified fraudulently. Apart from having the right timekeeping system in place, employees must also adhere to strict policies for time entry, correction, and approval. Any manual changes to time entries need to be properly documented and approved within this system.

The technical specifications for a DCAA compliant time tracking system

If you’re in the market for a DCAA compliant time tracking tool, keep in mind there are specific technical requirements. You want to ensure the time tracking tool you choose ticks the following boxes.

- Has edit controls and is tamper-proof

- Allows for both automated and real-time recording

- Can separate direct and indirect labor hours

- Has secure access controls and user authentication

- Provides detailed audit trails and access to historical data

Beebole: A DCAA compliant time tracking tool that puts security first

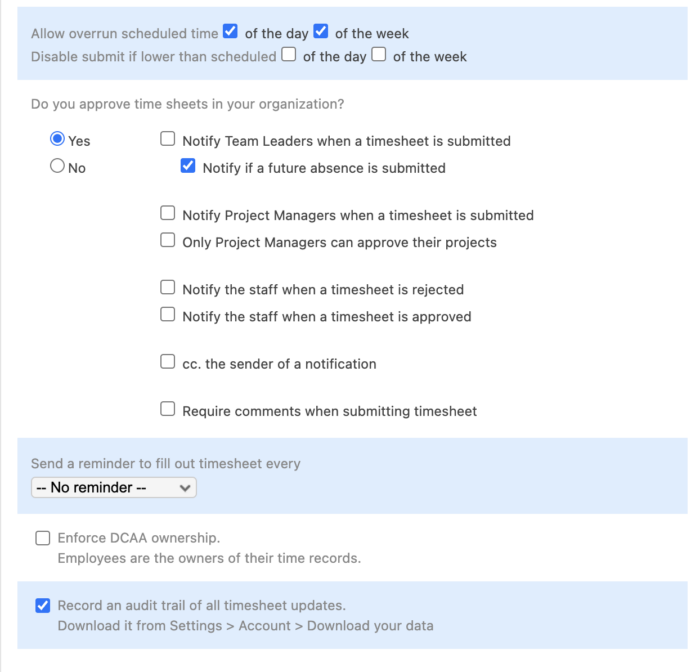

Beebole is a DCAA compliant project time tracking tool that’s been trusted by thousands of customers worldwide since 2008. Since day one, security has been top of mind. With Beebole, you can count on unlimited record retention with the optional deletion of data for individual users. You can also rest assured that there are daily backups with a retention cycle of 30 days, as well as a 90-day internal log to easily analyze and optimize for errors. It’s also simple to export any or all time data, and there are audit trail reports that track detailed information on all changes to time entries. Of course, all of these features make Beebole an ideal choice for a DCAA compliant time tracking tool.

DCAA compliance at the implementation and operational level

Choosing a compliant time tracking tool is just one piece of the puzzle. Apart from the right software that meets the above requirements, you also need to make sure that you’re following the DCAA regulations at the implementation and operational levels.

- Proper training: It’s important for employees to understand the best practices when it comes to DCAA-compliant time tracking. Training must cover how to report absences, holidays, and overtime, as well as general use of the timekeeping system and its related procedures. These procedures should also be documented for easy access and reference.

- Internal audits & reviews: There should be regular internal audits and reviews to ensure there are no compliance issues before an audit happens.

- Approval flow: Supervisors need to be able to sign off on all employee time tracking.

- Segregation of duties: The person approving the timesheets within the organization should not be the same person entering the data into the timekeeping system.

- Established procedure for corrections & discrepancies: If employees need to edit their time entries or fix a discrepancy, there should be an established procedure and approval flow to follow. This counteracts potential fraudulent time tracking issues.

- Record keeping: The DCAA requires all time keeping records to be kept for a minimum of three years.

- Thorough audit trail: Having an easy-to-access audit trail is key. This trail should show the date and time of any changes made to time tracking, the employee making the change, and the reason for the change.

Ready For Peace of Mind?

One less thing for you to worry about because we take DCAA compliance very seriously.

DCAA compliance in the real world: A best practice

All this theory is great, but what does DCAA compliance look like in (best) practice? We’re glad you asked. Let’s see how companies today have successfully handled DCAA compliance and what we can learn from them.

A DCAA compliant company success story

Navteca is a tech company focused on emerging technologies and IT innovation. They develop, execute, and manage technical solutions for government clients like NASA (The National Aeronautics and Space Administration) and NOAA (National Oceanic and Atmospheric Administration), as well as within the private sector for corporations, nonprofits, and more.

With such large U.S. government clients, it’s clear DCAA compliance was extremely important to Navtec. CTO Ramón Ramirez-Linan said that they wanted to be ready for an audit at any moment, which meant that they needed a tool that kept secure logs of hours worked and an audit trail of any and all changes made.

Ramirez-Linan decided to work with Beebole after looking at various tools. Beebole was affordable, trustworthy, and easy to use. And because Beebole is committed to remaining a DCAA-compliant time tracking tool, Navteca can rest assured that if audited, they have all the needed information stored securely.

According to Ramirez-Linan, “There are two types of solutions out there, the ones that are like vitamins, you take them even though you don’t really need them, and others that are like aspirins, you need them to take your headache away. Beebole took my headache about timekeeping away.”

DCAA: a must for DoD contractors

As a government contractor, DCAA compliance isn’t a suggestion but a requirement. If winning government contracts and continuing to build a relationship with entities like the DoD is a piece of your business’ longevity plan, DCAA compliance should be a top priority. This agency’s role is simply to ensure that companies offering services to government agencies aren’t mishandling the money in any way. This type of check-and-balance dynamic is in everyone’s best interest, and by following the guidelines detailed in this article, it’s an attainable framework to master.

Apart from being proactive with your financial reporting and timekeeping, remember to keep up to date on the DCAA’s latest rules and regulations. Aside from ensuring that your project time tracking and accounting software is compliant with the DCAA, remember that there are everyday operational requirements to follow, too.

Related posts

The 12 best time tracking tools to track billable hours for projects

Published: 2024/11/5 | Katie StearnsTime tracking tools to track billable hours have become indispensable assets for operations and finance managers seeking to optimize profitability and maintain precise project cost control. By accurately capturing the time spent on various tasks and projects, these applications provide helpful information for workflow efficiency, resource allocation, and billing accuracy. Also, they eliminate the guesswork and potential errors associated with manual time […]

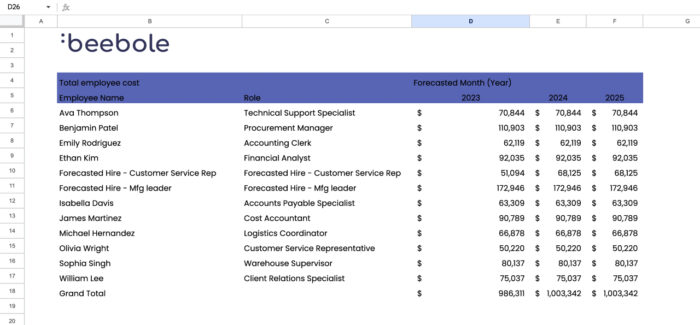

The true cost of employees: Calculate employee cost with this labor cost spreadsheet

Updated: 2023/7/19 | Carlos QuintanaUnderstanding the true cost of employees is crucial for any business looking to manage resources effectively. That’s why we’ve created this free spreadsheet download and video tutorial with detailed instructions and formulas to easily calculate employee cost at your company, as well as to forecast new hires. It’s more than just base salaries; it encapsulates […]

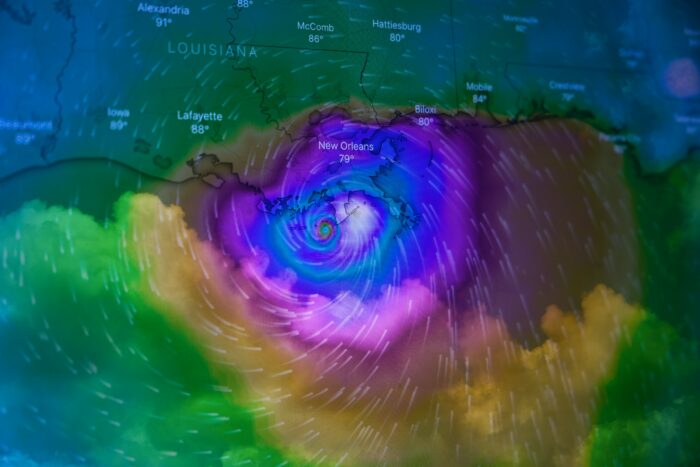

Project cost management: Adjustable forecasting and the Excel OFFSET function

Published: 2023/9/5 | Andrew ChildressToday we’re talking project cost management with adjustable forecasting and the Excel OFFSET function. Follow along below, or watch the tutorial on YouTube by clicking here. The first time you heard about a forecast, it probably had nothing to do with project cost management. The team of weather experts behind that forecast used a range […]