Table of Contents

Table of Contents

When it comes to non-billable hours, businesses can totally reframe how they approach them. Rather than a knee-jerk reaction of directly trying to reduce non-billable hours, reframing your mindset to how best to manage non-billable hours can actually give you the upper hand.

Non-billable hours: Strategic investment

Your clients expect to be billed only by the quality work that your company does that delivers the requested services and/or generates value on their behalf. Technically speaking, everything else falls into the realm of non-billable work.

In other words, non-billable work refers to the tasks and activities performed by employees that cannot be charged to a client. These activities are essential for the functioning and growth of the business but do not generate direct revenue. Some of these activities include the following:

- Administrative tasks (e.g., scheduling, paperwork)

- Internal meetings

- Training and professional development

- Marketing your business

- Research and development (if not directly billable to a client)

- Maintenance and upkeep of office or equipment

- Networking

Non-billable hours are classified as the time employees spend on non-billable work. This term measures the duration spent on activities that do not directly produce revenue. For instance, you can’t bill your clients for things like training your employees, marketing your business, or networking. So, how can that non-billable time be considered a strategic investment if you can’t get any direct revenue from it?

There are a couple of things. First, some of those non-billable hours are necessary to run your business. You can’t bill your clients for the time one of your employees is spending making photocopies and organizing files in your organization. However, this is something that is part of running your business and you still have to pay your employees for the time they spend doing that kind of work.

Second, some of that non-billable time can be managed as an investment towards the future. If you understand that some portion of non-billable work will contribute to the long-term growth and success of the company, it’s easy to see just how necessary it is. For example, training your finance employees on AI and data analytics can be seen as an investment if your company plans to automate certain procedures to maximize insights and promote better decision making.

Similarly, if your law firm decides to support one of your senior associates in his efforts to join the National Bar Association with the idea that he gains prominence and brings more referrals to the firm, that too can be managed as a strategic investment.

In such contexts, non-billable time becomes a strategic investment because it offers real value to the company. Of course, you have to measure and monitor the return of investment of those non-billable hours and see if they are effectively improving and bringing more business to your organization.

UK technology firm Cloud Perspective has mastered this. They use Beebole to track both billable and non-billable hours across multiple clients and projects. By going beyond a simple billable/non-billable split and adding a “credit” category for strategic non-billable work, they gained the visibility needed to:

🚀 Identify how much time was spent on revenue-generating vs. internal growth activities

🚀 Treat certain non-billable hours as investments instead of wasted cost

🚀 Analyze productivity at both the individual and company level through customizable dashboards and exports

“It is particularly useful to be able to log time as both billable and non-billable – and indeed one of the features that we have recently started using is the ability to have custom picklists. We have one for Billable, Non-billable, and Credit.” – Miranda Pocock, Founder & CTO, Cloud Perspective

Needless to say, the money that you are investing in covering the non-billable hours associated with the training of your finance team or the efforts carried out by your senior associate should be considered a strategic investment in your company because of the potential value they can generate for your business.

In the case of the lawyer, “the non-billable time expended by the associate becomes qualified non-billable time (QNBT). It is not merely discretionary time, nor is it perceived to be something that can be conjured at will, but rather it is something that has been vetted and will be measured against a set of objectives,” explains Gerry Riskin, founder at Edge International, a global consultancy specializing in the legal and other professional services’ sectors.

Non-billable hours: Hidden costs

Non-billable hours are essential for the functioning and growth of the business. Furthermore, when they provide value to the company’s own growth, they can be managed as strategic investments. That said, non-billable hours can also become hidden costs when they meet the following two conditions:

- They are part of inefficient processes and/or don’t provide any value to the company.

- They aren’t properly managed or accounted for.

The most common scenario for this to happen is quite simple: Many companies simply don’t track their non-billable time because they don’t see the need for it. If that’s the case and there’s an inefficient process within your company that you don’t keep track of, you would probably be unaware of the cost associated with that process.

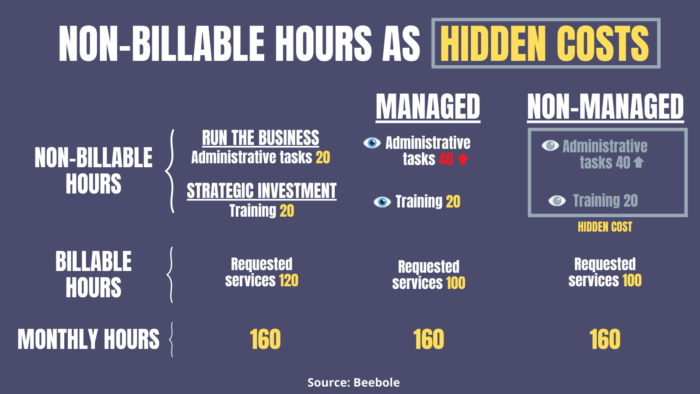

In the following image, you can see how a company can lose sight of additional costs at the administrative level when it doesn’t manage its non-billable hours:

If the company manages its non-billable hours, it can easily identify, and eventually fix, the issue associated with the hourly increase on administrative tasks (from 20 to 40 hours). However, if the company doesn’t manage its non-billable work, it would be difficult to see the costs generated by potential inefficiencies at the administrative level.

The following are some of the negative effects that hidden costs can have on a company’s profitability and efficiency:

- Reduced profit margins

- Inaccurate financial reporting

- Poor budgeting and forecasting

- Increased operational costs

- Resource misallocation

- Strained cash flow

- Decreased competitive edge

Most large companies, however, usually track their overall costs in one way or the other so there’s little “hidden” about the cost associated with non-billable hours. In fact, most experts we talked with argue that non-billable hours aren’t considered an investment or hidden cost.

According to a senior manager who works for an international financial institution, a larger firm not only has a history of the costs related to meetings, traveling and training, but can also average out the costs over many clients, so these costs should not be hidden but explicitly estimated and taken into account when deciding on the rates that the clients are charged. “In that sense for a bigger firm I dont think non-billable hours are either an investment or a hidden cost,” states the senior manager.

Aaron Brown, finance expert and columnist at Bloomberg, goes even further by saying that the pay, not the hour, is what really counts as an investment or cost. “If a company assigned non-billable work to employees—say for professional development or overhead tasks not specific to individual clients—then the cost for that work could be either an investment (professional development) or expense (overhead)—but it’s the pay that’s the investment or expense, not the hours,” argues Brown.

Challenges in managing non-billable hours

“Non-billable time is often not tracked accurately,” states Riskin. When we asked him about that, he pointed out two fundamental reasons:

- Companies don’t understand the value of non-billable hours.

- Companies don’t know how to classify non-billable work.

Some companies don’t even ask their employees to track their non-billable time just because they don’t care and they don’t understand it has value so they are fine with throwing it away. This is also why there is a lot of resistance to investing in non-billable hours in the corporate world.

On the other hand, companies don’t know how to classify non-billable work, and they don’t ask their employees for a little bit of discipline as to correctly recording it by category just as they would with billable-time.

Apart from these two fundamental problems, and even if they are willing to track non-billable time, companies often don’t have a good tracking system to categorize and manage non-billable hours. This poses a practical problem for many organizations.

Last but not least, some companies are afraid to compromise profitability with non-billable hours that don’t generate revenue. This broad misconception not only affects the ability of the company to balance non-billable activities with billable work but also can lead to other issues such as employee burnout and low productivity.

The #1 tip for maximizing the strategic value of non-billable hours

When it comes to non-billable hours your focus shouldn’t be on reducing them but rather on maximizing their strategic value. If you want to achieve that, the recipe is simple: You need to manage your non-billable hours.

According to the senior manager we talked to, the best way to deal with non-billable hours without compromising the profitability of the organization is by taking them into account. In other words by managing them effectively.

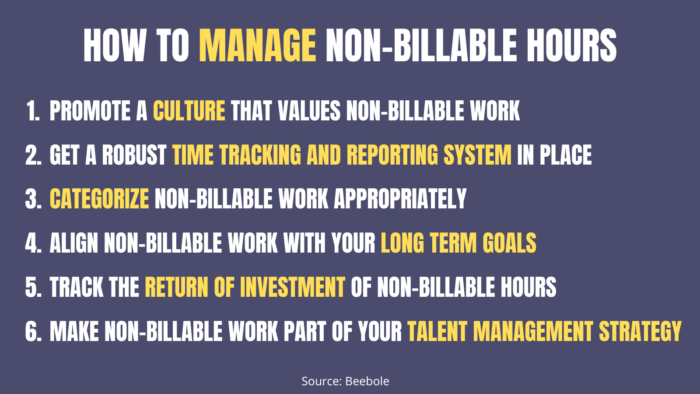

But how can businesses track and manage non-billable hours effectively? First, you need to cultivate a culture that values strategic investments in non-billable time. Second, you need a robust time tracking and reporting system in place. Third, you need to categorize non-billable work appropriately (just as you do for billable-time). Fourth, you need to prioritize non-billable work aligned with your long term goals. Fifth, you need to track the return of investment of non-billable hours.

How Beebole can help you effectively manage non-billable hours effectively

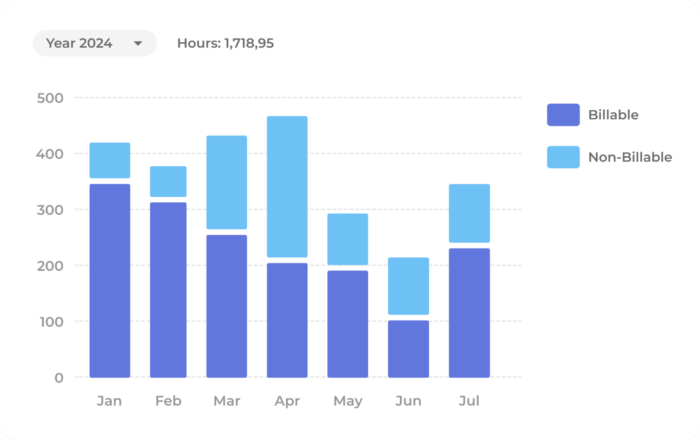

Beebole makes tracking billable vs. non-billable hours easy with a simple checkbox feature. This can help you easily see and understand the billable vs. non-billable hour breakdown within projects, tasks, and even by employee.

By using a tool like Beebole to track your billable and non-billable hours is the first step in effective management of them. Having employees track their billable and non-billable time allows you to then better understand the demands of certain projects and clients, and how those demands relate to overall profits. This type of reporting and analysis can all be done within Beebole itself or within Google Sheets or Excel.

Beebole Can Help With Your Non-Billable Hours Management

Furthermore, if you are able to design your talent management strategy around all of this, you will significantly maximize the value of your non-billable hours, which is something that could lead to numerous benefits in terms of employee engagement, productivity, and profitability.

As explained by Riskin, when a law firm decides to have an aggressive non-billable budget for a senior associate because he’s very good at attracting work, clients love him, and he is able to keep a high level of satisfaction, the firm knows very well that the senior associate will bring them more prosperity through his ability to attract work than actually billing hours.

“A well-managed firm sees the people in the firm, the talent in the firm as their biggest asset. The talent can be deployed for billable purposes and non-billable purposes. Managed well, they will be deployed appropriately for the appropriate billable work and the appropriate non-billable activities. Manage that well, you could be profitable,” affirms Riskin.

Managing non-billable hours: A best practice to adopt

Non-billable hours are as precious as billable hours, and forward-thinking organizations know very well that if you want to run your business smoothly and enjoy sustainable growth, you need to make an effort to manage your non-billable hours.

Some organizations have been quite successful in doing this. As Riskin illustrated to us, a very prosperous Chicago law firm has based its success on the following (almost heretical) principle: An hour of non-billable time is more valuable than an hour of billable time.

“This did not mean that spending eight non-billable hours and no billable hours in a day was considered more valuable for the firm. Not at all. Rather, the firm decided that those who spend ten billable hours and no non-billable hours are depriving the firm of the strong return that it would obtain on having at least one quality non-billable hour from that individual in a day,” states Riskin.

Their philosophy was quite simple: “If you and I come to work and we don’t even have one quality non-billable hour, we are doing ourselves and the firm a great disservice,” explains Riskin.

There is no doubt that avoiding hidden costs is one of the major benefits of managing your non-billable work effectively. However, managing your non-billable hours is more about investing time and resources in activities that provide value to your organization. This is why implementing this process is one of the best practices that your business can adopt today. Is your organization ready to manage non-billable hours?